RBI MPC Meeting: RBI has not made any change in the key interest rate this time too. The Reserve Bank of India has kept the repo rate unchanged at 6.5 percent since February 2023.

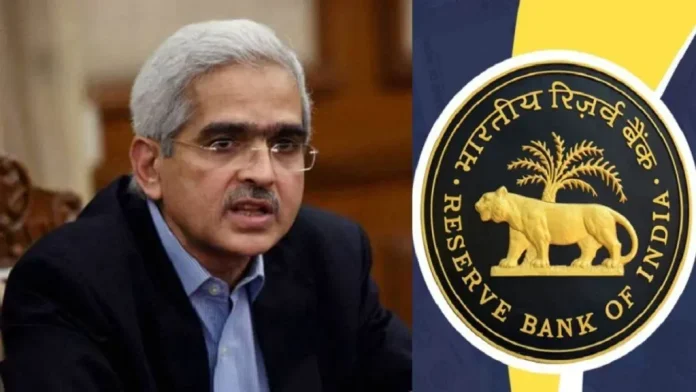

RBI MPC Meeting: The Reserve Bank of India has kept the key interest rates unchanged this time too. The RBI has not made any change in the key interest rate i.e. repo rate. RBI Governor and MPC Chairman Shaktikanta Das gave this information while announcing the decisions of the MPC today. The meeting of the RBI Monetary Policy Committee started on Monday. Earlier this month, the government had reconstituted the rate-setting committee of the Reserve Bank of India – the Monetary Policy Committee (MPC). In this, the reconstituted committee with three newly appointed external members has held this meeting this time. The Reserve Bank of India has kept the repo rate unchanged at 6.5 percent since February 2023.

Policy stance made neutral

RBI Governor Shaktikanta Das said that in the MPC meeting, it has been decided to keep the repo rate unchanged at 6.5 percent. Also, the policy stance has been made neutral. The RBI governor said that the GDP growth rate is expected to be 6.7 percent in the first quarter. The governor said that manufacturing is showing signs of slowdown.

Market boom after RBI’s decision

The stock market has seen a positive response to the RBI’s decision. The Bombay Stock Exchange index Sensex jumped 500 points. At the same time, the National Stock Exchange’s Nifty jumped 150 points.

Also Read- Warning for PAN Card Holders! If you ignore it, you will be left with nothing but regret

7.2% growth rate estimated this year

RBI Governor Shaktikanta Das said that the Monetary Policy Committee has estimated the GDP growth rate to be 7.2 percent in the financial year 2025. The RBI governor said that domestic growth is continuously maintaining its momentum. He said, ‘At the same time, the global economy is maintaining its resilience. However, downside risk remains due to geopolitical tensions, fluctuations in the financial market and increased government debt. At the same time, the positive thing is that world trade is showing signs of improvement.’

Inflation under control

The RBI governor said that due to good kharif acreage and good rainfall, the pressure of food inflation has come down. He said, ‘It seems that the core inflation rate has come down to a lower level.’

What are the experts saying

Santosh Meena, Head of Research at Swastika Investmart, said, ‘RBI has announced a balanced monetary policy, choosing to keep interest rates unchanged. At the same time, the RBI has chosen to keep its stance neutral. The RBI governor addressed key factors such as geopolitical tensions, inflation, economic growth and risks within the NBFC sector. However, from the market point of view, the MPC decisions are positive. There was no explicit mention of a rate cut, but subtle hints in the governor’s speech point to the possibility of a rate cut in the upcoming policies.’ He said, ‘Markets are expected to react positively, with the Nifty likely to target 25,330 and 25,500 levels in the near term. Similarly, Bank Nifty can target 51,700 and 52,300 as immediate targets.

Related Articles:-

Top 5 most affordable bikes in India, if you buy during Navratri, check details