Kisan Vikas Patra: Your money will double with this government scheme, know in how much time and how

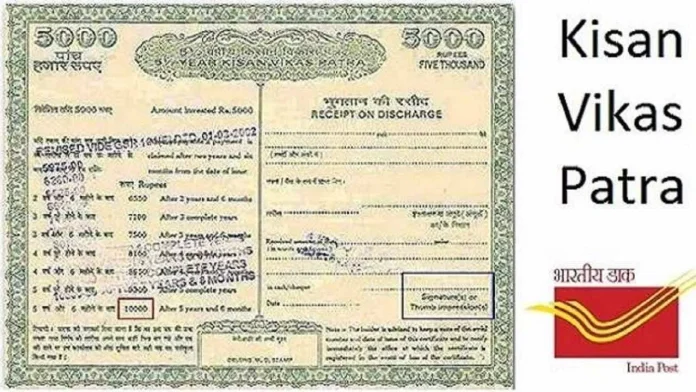

Kisan Vikas Patra Double your Money: Kisan Vikas Patra is a fixed rate small savings scheme (Government Small Savings Scheme). Which has been designed to make investment easy to understand. In this, a certificate is issued to the investor and at the time of maturity, the investment amount is doubled. That is, the investor does not have to calculate the investment much and he knows after how much time his money will double. The goal of this scheme is to promote long-term investment without risk among the common people. And more and more people can save money for their future. But…

How long does it take for the money to double under Kisan Vikas Patra? Know in detail –

How long will it take for your investment to double in Kisan Vikas Patra depends on the interest rate at the time of your investment. As per the latest update, the interest rate for KVP is 7.5 per cent, and at this rate, the money will double in about 115 months (9 years and 7 months). The period for doubling your investment is linked to the interest rate announced by the government, so it is important to check the current rates before investing.

Also Read- PM Awas Yojana: Keep these three rules in mind, otherwise the government will recover the subsidy money

How to buy Kisan Vikas Patra?

- You can buy KVP from any post office or designated banks across India. Know the step-by-step process on how to buy KVP-

- Visit a post office or bank: KVP certificates are available at any post office and select banks.

- Fill the application form: You need to fill a KVP application form and provide identity proof like your Aadhaar card or PAN card.

- Make payment: You can invest as little as ₹1,000 and increase it in multiples of ₹1,000.

- Get the certificate: Once your payment is done, you will receive a KVP certificate as proof of your investment. You can opt for a physical certificate or an electronic certificate (eKVP).

- Since KVP is backed by the Government of India, your investment is safe.

Related Articles:-

Jio reduced the price of these recharge plans by Rs 200, check plan details

New features of Samsung Galaxy S25 5G revealed, know when it will be launched