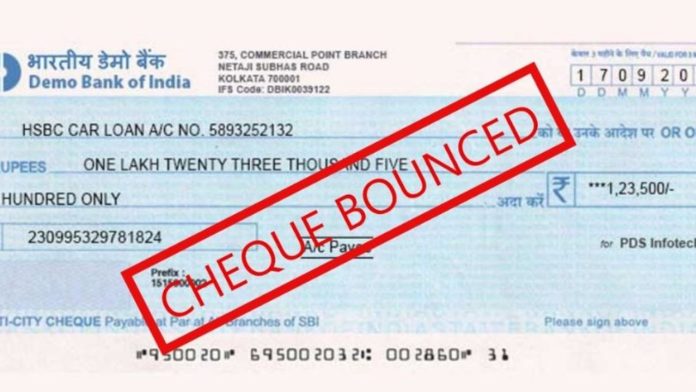

Check Bounce Penalty Rules: Many banks charge different penalties when a check bounces and you must know the check bounce penalty rules of which bank your account is in or else you can get into big trouble.

Check Bounce Penalty Rules: We all definitely get to hear about the check. Those who do the work of banks, they are very familiar with checks and they also know that online mode and UPI etc. are the mediums for money transactions nowadays, but the work of withdrawing money from checks has been going on for years.

However, there is one thing which people know a little less is that if the check bounces or is rejected, then people have to pay penalty and its effect can also come in CIBIL history. Even in more serious cases there is a provision for punishment. Here you can know how much penalty can be imposed if the check bounces.

What is check bounce

when someone gives a check to the bank for payment and if it is rejected due to lack of money in the account or any other reason, then it is called check bounce. There can be many reasons for this, but the main reason is not enough money in the account. Let us tell you that even if there is a difference in the sign on the check, it gets bounced.

Know how much penalty is

deducted from the account as penalty in case of check bounce. On check bounce, you have to inform the debtor and that person is required to pay you in a month. If the payment is not made within a month, then a legal notice can be sent to him. Even after this, if he does not give any answer for 15 days, then a case can be filed against him under section 138 of the Negotiable Instrument Act 1881.

Bounce

check is a punishable offense and a case can be registered under section 138 for it. There is a provision of fine or imprisonment for two years or both. In case of check bounce, the debtor has to pay the amount with 2 years imprisonment and interest. The case will be registered at your place of residence.

What is the penalty for bounced check of ICICI Bank

Rs 350 (one check returned in a month) on checks issued by the customer, Rs 750 if the check is returned twice in the same month due to financial reasons. 50 will be charged if there is a reason other than signature verification and the check is returned due to financial reasons.