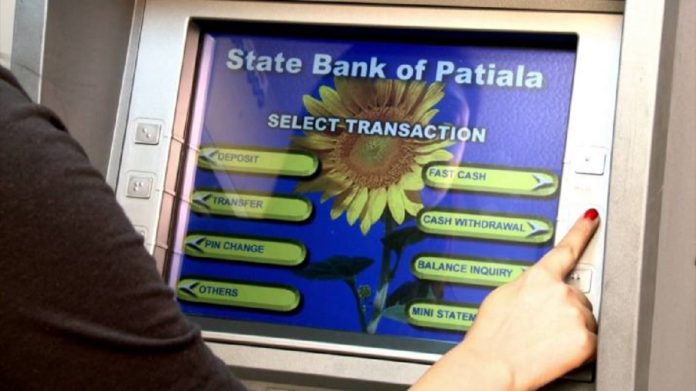

SBI Cash Withdrawal Rule: Rules have changed for withdrawing cash from ATM, know otherwise your money will get stuck

January 2022 New Bank Rule: Banking customers will be able to do three transactions in metro cities and five transactions in non-metro cities in a month from ATMs of banks other than their banks.

From the beginning of the new year, withdrawing cash from ATM more than the fixed limit is going to be expensive. Now for this, there will be more burden on the pockets of the customers and now they will have to pay a higher price. According to the instructions issued by the Reserve Bank of India (RBI) in June, customers of banks will have to pay Rs 21 for ATM withdrawals in excess of the free limit from January 1, 2022.

5 free transactions every month

At present, banks are allowed to charge a fee of Rs 20 for cash withdrawals in excess of the prescribed limit. It is a matter of relief for banking customers that even though the fee rate will increase from January 1, they will be able to do ATM Free Transactions Limit five times a month as before. This includes cash withdrawals as well as non-financial transactions.

Apart from this, banking customers will also be able to do three transactions in a month in metro cities and five transactions in non-metro cities from ATMs of banks other than their own bank. RBI had earlier allowed banks to levy an ‘interchange’ fee of Rs 17 for financial transactions and Rs 6 for non-financial transactions. This increased rate was to come into effect from August 1, 2021.

Banks try to reduce spending

The decision to increase the transaction fee has been taken due to the increase in the cost of banks related to installation and maintenance of ATM machines. This is expected to strike a balance between the expectations of the financial entities and the convenience of the customers.

In June 2019, the central bank had formed a committee headed by the Chief Executive of Indian Banks’ Association to review ATM operations. At the end of the financial year 2020-21, there were 1,15,605 ‘onsite’ (in bank premises) ATMs and 97,970 ‘offsite’ (other than bank premises) ATMs across the country.