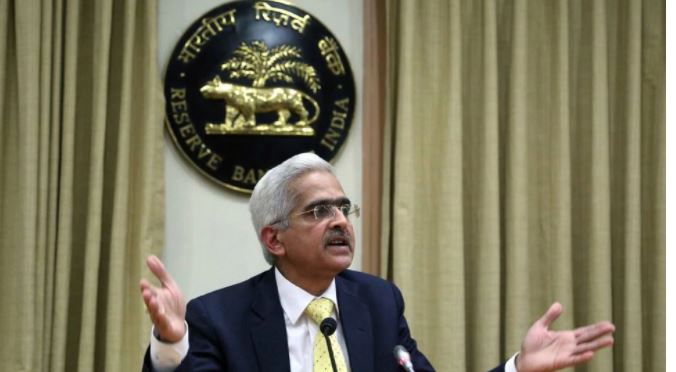

RBI Governor Statement: A statement is going to be made on behalf of RBI Governor Shaktikanta Das on Wednesday afternoon. However, it is not yet clear on which issue he will speak. But some media reports are claiming that an announcement to increase the repo rate can be made.

RBI Governor Shaktikanta Das statement: A statement will be issued on behalf of Reserve Bank of India Governor Shaktikanta Das at 2 pm on Wednesday. However, no information has been received yet on which matter he will speak?

Inflation rate remains above 6 percent

The statement of the Governor of the Reserve Bank has come ahead of the Federal Reserve meeting to be held this week. It is expected that the Federal Reserve can increase the interest rate by 0.50 percent. Let us tell you that the rate of inflation in the country has remained above 6 percent for the second consecutive month.repo rate may increase

It is being claimed in some media reports that the governor of the central bank can announce to increase the repo rate. Let us tell you that at present the repo rate of RBI is at 4 percent. The central bank last changed the repo rate on 22 May 2020, since then the repo rate has not been changed yet.

What will be the effect?

If the repo rate is increased by RBI, then it will affect crores of customers of banks. By increasing the repo rate by the central bank, banks will make the loan given to the customers expensive. The effect of increasing interest rate will be on EMI. The EMI of the customers will increase as compared to earlier.

What is repo rate?

The rate at which loans are given by RBI to banks is called repo rate. The increase in the repo rate means that banks will get loans from RBI at a higher rate. This will increase the interest rate on home loan, car loan and personal loan etc., which will have a direct impact on your EMIs.