SBI ATM Withdrawl Rule: If you also withdraw money from ATM, then know that now the rules for withdrawing money from ATM have changed. SBI has taken this step for the safety of customers and increasing cases of fraud. Let us know its process.

SBI ATM Withdrawl Rule Changed: If you also withdraw money from ATM, then know that now the rules for withdrawing money from ATM have changed. SBI has changed the rules to make ATM transactions more secure. Let’s know about the new rule.

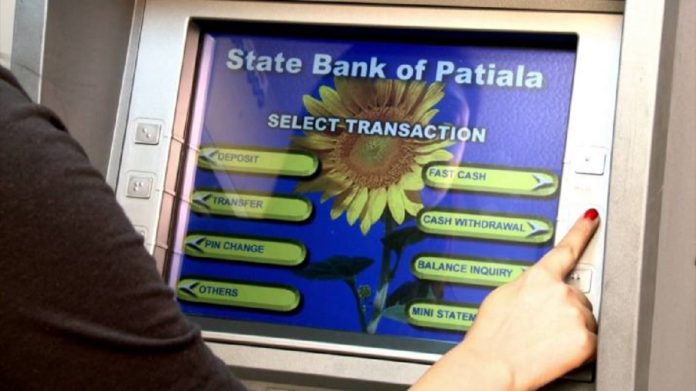

Now you have to enter OTP to withdraw cash from SBI ATM. Now under the new rule, customers cannot withdraw cash without OTP. At the time of cash withdrawal, customers get an OTP on their mobile phone, only after entering which the cash is withdrawn from the ATM.

Bank gave information

Giving this information in a tweet, the bank said, ‘Our OTP based cash withdrawal system for transactions at SBI ATMs is a vaccination against fraudsters. Protecting you from fraud will always be our top priority. SBI customers should be aware of how the OTP based cash withdrawal system will work.

Know what is the rule now?

Let us tell you that these rules are applicable on Rs 10,000 and above. SBI allows customers to withdraw Rs 10,000 and above from their ATM every time with an OTP sent from their bank account to the registered mobile number and their debit card PIN.

Know the new rules

- To withdraw cash from SBI ATM, you have to enter an OTP.

- For this an OTP will be sent to your registered mobile number.

- The customer will get the OTP with the four digit number for a single transaction.

- You have to enter the OTP received on the mobile number registered with the bank in this screen for cash withdrawal.

Why were these rules made?

Regarding making this rule, the bank has said that this rule has been made to protect the customers from fraud. Significantly, the country’s largest public sector bank SBI has the largest network of 22,224 branches and 63,906 ATM/CDM with 71,705 BC outlets in India.