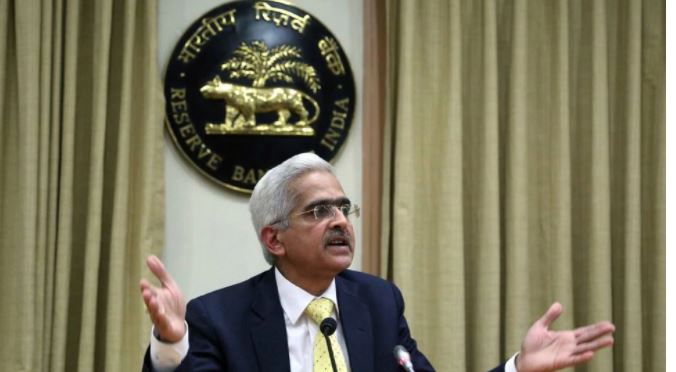

In an interview given to CNBC-TV18 channel, RBI Governor Shaktikanta Das has again indicated an increase in the repo rate.

In the first week of May, the Reserve Bank of India (RBI) called a meeting of the Monetary Policy Committee (MPC) and announced an increase in the repo rate by 0.40 percent. Now RBI Governor Shaktikanta Das has again indicated an increase in the repo rate. Explain that due to the increase in the repo rate, the EMI burden on home loan, car loan borrowers may increase.

After the reduction in excise duty on petrol and diesel by the central government, Shaktikanta Das said in a conversation with CNBC-TV18 channel on Monday that the repo rate will be increased in the upcoming MPC meeting. He said that the MPC will continue to increase the interest rate to keep inflation under control, but it is too early to say that the repo rate will increase to the pre-covid level.

Das said, “It is not a very difficult task to estimate the rate hike. Repo rate will increase a little, but I cannot say anything about how much it will increase. But it would not be correct to assume that it will increase to 5.15 percent. The market’s guess is correct that the MPC wants to increase the rate in the next meeting.”

MPC meeting to be held from 6-8 June The MPC meeting

of RBI is going to be held from 6-8 June. Shaktikanta Das will tell about the decisions of the MPC meeting on June 8.

Fiscal and monetary actions are being

taken Regarding inflation, Das said that now fiscal and monetary actions are being taken in coordination to control inflation. The recent fiscal measures will have an impact on inflation in the times to come.