Bank Loan Big Recovery News: Keeping in mind the interest of customers, RBI has issued an order for banks. Under this, the RBI has ordered banks to stop sending objectionable messages, slander on social media, also banks and other institutions.

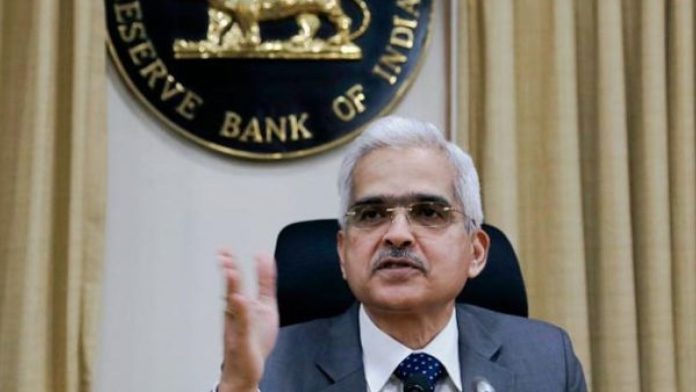

Bank Loan Big Recovery News: If you have also taken a loan from the bank, then there is important news for you. Now banks cannot forcefully recover the loan from you under any adverse circumstances. Actually, the Reserve Bank of India (RBI) has issued a new circular for all banks and financial institutions. In this order, banks have been asked to stop incidents of threatening, harassing, misuse of personal data of customers taking bank loans.

It has also been said in this that banks should also stop incidents of harassing relatives of borrowers, even known people. This circular of RBI is applicable to all commercial banks, all non-bank financial companies, asset reconstruction companies, All India Financial Institutions and all primary urban cooperative banks.

Solar New Generator: Use this small solar to run on TV and laptop, avail big benefits

prevent such incidents from spreading

According to the news published in our affiliate website Zee Business, RBI has clearly said in its order that banks and other institutions should also stop the incident of sending objectionable messages, defaming on social media. In fact, in recent months, there have been many cases of arbitrariness and coercion by recovery agents in loan apps cases. In this new circular, RBI also said that according to the rules, customers should not be called for recovery (RBI New Circular for Recovery Agent) before 8 am and after 7 pm. Along with this, RBI also said that the institutions should properly follow the rules from the recovery agents. Do not recover from them by harassing the customers.

RBI showed strictness

In fact, RBI has advised in the circular, ‘Banks or institutions or their agents shall not resort to any kind of threat or harassment of any kind. Will not use verbal or physical acts against any person in their attempts to recover their loans. RBI has clearly said that if there is a complaint from the customer, then we are going to take it very seriously.