Income Tax Return: For example for Rs 7.27 lakh, now you do not pay any kind of tax. The break even comes only at Rs 27,000. After this you start paying tax.

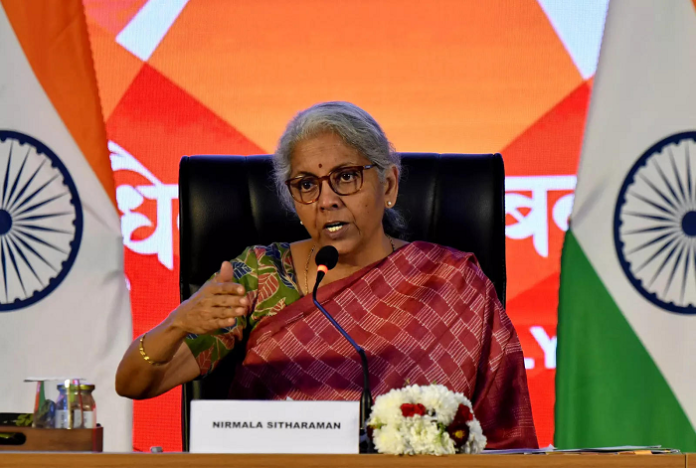

ITR Filing: Modi government has taken a big step regarding relief from income tax. In Udupi, Union Finance Minister Nirmala Sitharaman said that the Modi government has provided many tax benefits to the middle class. Under this, those earning up to Rs 7.27 lakh every year will not have to pay any tax. He said, the government has not spared any section of the society. He said that some people had doubted this when it was decided to provide income tax exemption for income up to Rs 7 lakh in the Union Budget for the year 2023-24.

What will happen to the income above Rs 7 lakh?

People had doubts about what would happen to those earning more than Rs 7 lakh. After that we sat as a team and went into the details. We find out at what level you pay tax for every Rs 1 extra. For example for Rs 7.27 lakh, you do not pay any tax now. The break even comes only at Rs 27,000. After this you start paying tax.

Standard deduction of Rs 50000 also

Nirmala Sitharaman said that now you also have a standard deduction of Rs 50,000. Under the new tax regime, there was a complaint that there is no standard deduction. It is a given now. We have brought ease of payment. Speaking about the achievements of the government, he said that the total budget for Micro, Small and Medium Enterprises (MSME) has increased to Rs 22,138 crore for 2023-24 as compared to Rs 3,185 crore in 2013-14.

Nearly seven times increase in budgetary allocation

He said that there has been an increase of about seven times in the budgetary allocation during nine years. This is a symbol of the unwavering commitment of the government to empower the MSME sector. Under the Public Procurement Policy Scheme for Micro and Small Enterprises, 33 per cent of the total purchases made by 158 Central Public Sector Enterprises have been made from MSMEs. This is the highest figure ever.

India is being praised all over the world

He said, ‘We launched the TReDS platform (Trade Receivables Discounting System) so that MSMEs and other corporates do not face liquidity crunch due to non-payment by their buyers.’ Sitharaman said that ONDC has enabled MSME businesses to reach out to a large potential customer base. At the same time, he said that the world appreciates that India has done a good job in the business sector.

He also told that doing business in India has become easier than before. The minister said that India’s ranking in the Ease of Doing Business Index has improved from 142 in 2014 to 63 in 2019. We have significantly reduced the compliance burden by repealing over 1,500 archaic laws and nearly 39,000 compliances. He said, the Companies Act has been decriminalised.