Post Office – If you also want to get better returns on your investment, then this news is for you. Let us tell you that a bumper interest of 2.25 lakhs is being received on the investment of five lakhs in this ski of the post office.

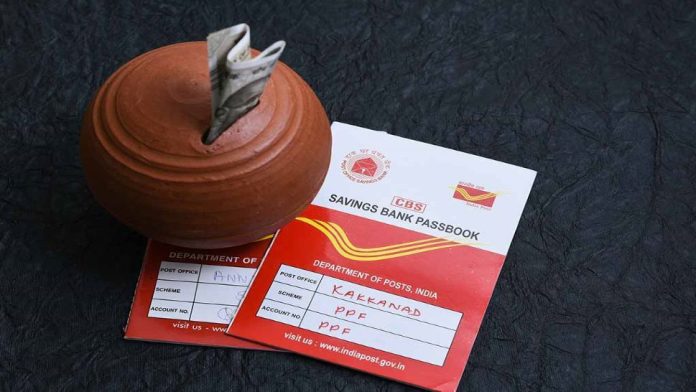

Post Office TD Calculation: Do you want to invest money in a scheme for 5 years, where there is no risk and earning is also good? Post Office Small Savings Schemes are the best option for risk-free guaranteed returns. One of these is the superhit time deposit (TD) scheme of the post office. In this scheme, lump sum deposits can be made for maturity of 1, 2, 3 and 5 years. On depositing money in this, interest rates are paid on an annual basis.

Know the details of interest rates-

The interest rate on 1 year time deposit of post office is 6.90 percent and 7 percent on 2 years. Apart from this, 7 percent interest is being received on 3-year deposits and 7.5 percent per annum on 5-year deposits. These interest rates are applicable from 1 July-30 September 2023.

₹ 2.25 lakh interest in 5 years on ₹ 5 lakh According to the Post Office TD Calculator, if you deposit Rs 5 lakh for 5 years, then the maturity amount will be Rs 7,24,974. That is, Rs 2,24,974 will be earned from interest. The deposit rates of Post Office Small Savings Schemes are reviewed every quarter by the government. This means that interest rates can change every quarter. However, in term deposits, the interest rates fixed at the time of deposit remain for the entire maturity period.

Tax deduction will be available on TD of 5 years –

The benefit of tax exemption is available on TD of 5 years in the post office. Tax deduction can be claimed on investment up to Rs 1.5 lakh under section 80C of income tax. Keep in mind here that the amount received on maturity in TD is taxable.

Single account and joint account are also opened under Post Office TD. Maximum 3 adults can be included in the joint account. This account can be opened with a minimum of Rs 1000. After this you can invest in it in multiples of Rs.100. There is no investment limit in Post Office Time Deposit.