Bandhan Bank Special FD : In Bandhan Bank Special Fixed Deposit Scheme, 8% interest is available for a limited period of time. Existing customers of Bandhan Bank can also avail FD booking or investment from the comfort zone of their homes or offices through retail internet banking or mBandhan mobile app.

Bandhan Bank Special FD : Bandhan Bank , one of the leading universal banks has started offering a special limited tenure of higher interest rates on fixed deposits. These rates are applicable for retail deposits up to Rs 2 crore and have become effective from today i.e. November 7, 2022. This will be applicable to fresh deposits as well as renewal of maturing deposits. With this new offer, Bandhan Bank is offering one of the highest interest rates on Fixed Deposits in the entire banking sector.

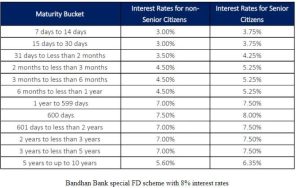

With this increase, customers will get a higher interest rate of up to 7.5% on deposits for a tenure of 600 days. Senior citizens can avail 0.50% or 50 bps more, which will take their returns up to 8% for FDs of 600 days tenor. The bank offers 0.75% or 75 bps higher interest rate for FDs of less than 1 year tenure to senior citizens.

Bandhan Bank Retail Domestic/Non-Resident Rupee Fixed Deposit Interest Rate

Existing customers of Bandhan Bank can also avail FD booking or investment from the comfort zone of their homes or offices through retail internet banking or mBandhan mobile app. With this online process, customers can book FD instantly without any hassle.

Private sector lender Bandhan Bank last month reported a net profit of 209.30 crore for the quarter ended September 2022 due to a fall in bad loans.

The Kolkata-headquartered bank had posted a net loss of Rs 3,008.60 crore in the same quarter a year ago on account of higher provisioning.