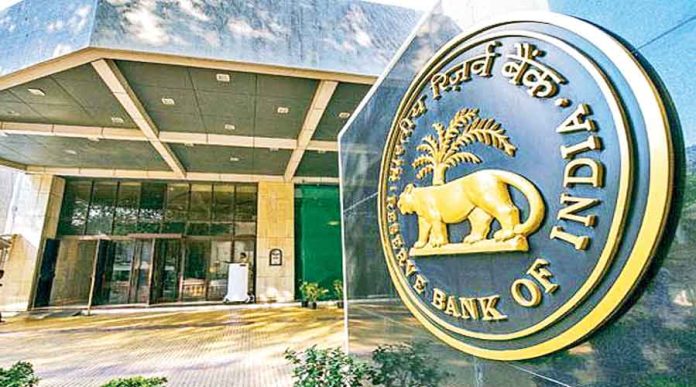

The Reserve Bank of India (RBI) has canceled the license of a Pune-based bank. The central bank said that the RBI Cancel License of Co-Operative Bank has been canceled due to the company’s earning potential and lack of capital.

The Reserve Bank of India (RBI) has canceled the license of a Pune -based bank. The central bank said that the RBI Cancel License of Co-Operative Bank has been canceled due to the company’s earning potential and lack of capital. If you also have an account with this bank, then let us know what will happen to your money and how will the cancellation of the bank’s license affect the depositors.

An order has been issued by the Reserve Bank on October 10, 2022, in which “The Sewa Vikas Co-operative Bank Ltd. The license of “Pune, Maharashtra” (The Seva Vikas Co-operative Bank Ltd) has been canceled from tomorrow i.e. Monday. Banking business can also not be done due to cancellation of license. All business of this bank has been closed.

Further, RBI said that the Commissioner of Co-operatives and Registrar of Co-operative Societies, Maharashtra have also been requested to issue an order to close the bank and appoint a liquidator for the bank. The license of the Pune-based co-operative bank has been canceled for non-compliance of the provisions of Section 11(1) and Section 22(3)(d) of the Banking Regulation Act, 1949 as well as Section 56 of the Banking Regulation Act, 1949, the statement said.

What will be the effect on depositors

It has been said by the Reserve Bank that if the license of this bank is not canceled, then it would have been completely contrary to the interests of the customers and the money of the customers could also be lost. With this, this bank will be unable to pay the money of the customers. Now money cannot be deposited in this bank. Along with this, withdrawal has also been banned from it.

What will happen to the customers money

Upon liquidation, every depositor can get a deposit insurance claim amount from the Deposit Insurance and Credit Guarantee Corporation (DICGC) under the provisions of the DICGC Act, 1961 up to a monetary limit of Rs 5,00,000 . According to the bank’s data, around 99 per cent of the depositors are entitled to receive the full amount of their deposits from DICGC.