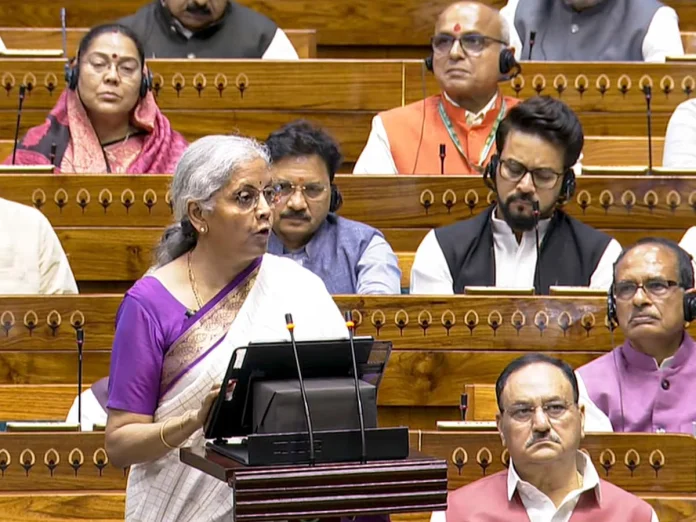

Budget 2024 Highlights: This is the first budget of the third term of the Modi government. This is the 13th budget of this government since the Narendra Modi government came into existence for the first time in 2014. Finance Minister Nirmala Sitharaman has presented the budget in Parliament for the 7th time. From common people to taxpayers, everyone is hoping for a reduction in tax slabs, increase in standard deduction and increase in exemption under 80C in the budget.

Union budget 2024 key Highlights and Important Announcements: On 23 July, Finance Minister Nirmala Sitharaman presented the full Budget 2024 in Parliament. This was Sitharaman’s seventh budget and the first budget of the third term of the Modi government. Due to elections this year, the interim budget 2024 was presented in the month of February. Many announcements have been made in the budget, including an increase in the limit of standard deduction for taxpayers and announcement of changes in income tax slabs. Stay tuned with Moneycontrol Hindi for instant information on the key points of the budget speech and further updates…

Nirmala Sitharaman Budget speech Highlights: The main points of the Finance Minister’s budget speech are as follows…

Under the new income tax system, the limit of standard deduction for salaried employees has been increased from Rs 50,000 to Rs 75,000. Apart from this, the tax rate has also been changed.

- Taxable income up to Rs 3,00,000: Nil

- Taxable income from Rs 3,00,001 to Rs 7,00,000: 5%

- Taxable income from Rs 7,00,001 to Rs 10,00,000: 10%

- Taxable income from Rs 10,00,001 to Rs 12,00,000: 15%

- Taxable income from Rs 12,00,001 to Rs 15,00,000: 20%

- Taxable income above Rs 15,00,000: 30%

No changes have been made in the budget under the old income tax system. After the new announcements, the salaried employee will get a tax benefit of up to Rs 17500 in income tax in the new income tax system. It has been proposed to increase the deduction on family pension for pensioners from Rs 15000 to Rs 25000.

The monetary limit for filing tax appeals has been raised to Rs 60 lakh for ITAT, Rs 2 crore for High Courts and Rs 5 crore for Supreme Court.

The exemption limit for capital gains tax has been increased from 1 lakh to 1.25 percent. Apart from this, long term capital gains tax has been increased from 10 percent to 12.5 percent. Angel tax has been announced to be removed for all types of startups. The corporate tax rate for foreign companies has been reduced from 40 percent to 35 percent. A comprehensive review of the Income Tax Act 1961 has been announced. This will reduce disputes and litigation. It is proposed to complete it in 6 months.

A comprehensive review of the customs structure will be undertaken in the next 6 months. TDS rate on e-commerce will be reduced to 0.1%. It is proposed to merge two tax exemption regimes for charitable works into one. It is proposed to decriminalise delay in TDS up to the date of filing of tax.

Cheap expensive

Basic custom duty on broodstock, polychaete worms, shrimp and fish feed has been proposed to be reduced to 5 percent. 3 drugs used in the treatment of cancer have been exempted from basic custom duty. Government reduced basic custom duty on steel and copper. Reduction in basic custom duty on leather, footwear has also been proposed. Custom duty on gold and silver has been proposed to be reduced to 6 percent and custom duty on platinum to 6.5 percent. 25 important minerals will be exempted from customs duty and basic custom duty on 2 of them will be reduced.

Foreign Direct Investment (FDI) and overseas investment regulations will be eased to increase FDI flow and enhance the use of Indian Rupee as a currency for overseas investment.

Promoting innovation, research and development: A National Research Fund will be set up to fund basic research and prototype development. A financing pool of Rs 1 lakh crore will also be created to promote private sector-driven research and innovation at a commercial scale.

Based on the success of the PM Svanidhi scheme, the government envisions another scheme for street vendors. It aims to support the development of 100 weekly haats or street food hubs over the next 5 years in selected cities.

States which have high stamp duty will be encouraged to reduce it for everyone. Apart from this, the stamp duty on property purchased by women will be considered to be brought down further.

BCD on mobile phones, mobile PCBS and mobile chargers was proposed to be reduced to 15%.

It has been proposed to set up a venture capital fund of Rs 1000 crore for space economy.

The fiscal deficit is estimated to be 4.9% of GDP by 2024-25. The target is to bring the deficit below 4.5%.

Assistance will be provided to develop the Vishnupad Temple at Gaya and the Mahabodhi Temple at Bodhgaya as world-class pilgrimage and tourist destinations.

Nalanda will be developed as a tourist centre and rejuvenated as per its glorious significance.

Help will be given to make Odisha a best tourist destination.

Rajgir will be developed extensively.

Significant investments have been made to build strong infrastructure. More than Rs 11 lakh crore has been allocated for capital expenditure for infrastructure development. This will be 3.4% of GDP.

Pradhan Mantri Gram Sadak Yojana Phase 4 will be launched to provide all-weather roads to 25,000 rural settlements. Assam will receive assistance for flood management and related projects. Himachal Pradesh, which has suffered extensive damage due to floods, will also receive support for reconstruction through multilateral assistance. Additionally, Uttarakhand, which has suffered extensive damage due to landslides and cloudbursts, will be provided with necessary assistance.

The target for capital expenditure has been kept unchanged at Rs 11.11 lakh crore. This is 3.4 percent of GDP.

More than 1.28 crore registrations were done and 14 lakh applications were received under PM Surya Ghar Free Electricity Scheme. A new policy will be introduced to promote pumped storage projects to facilitate seamless integration of renewable energy into power generation and overall energy mix. A joint venture of NTPC and BHEL will set up an 800 MW commercial plant using advanced ultra super critical thermal power technology.

Insolvency and Bankruptcy Code: An integrated technology platform will be created under the Insolvency and Bankruptcy Code to improve outcomes. Centre for Processing Accelerated Corporate Exit services will be provided for voluntary disclosure of LLPs to reduce closure time. Debt Recovery Tribunals will be strengthened and additional tribunals will be set up to expedite recovery.

12 industrial parks will be approved under the National Industrial Corridor Development Programme. A Critical Mineral Mission will be launched for domestic production of minerals, recycling and purchase of critical mineral assets abroad.

The government will bring a National Cooperative Policy for the regular, systematic and all-round development of the cooperative sector. The policy goal will be to develop the rural economy rapidly and generate employment opportunities on a large scale.

Power projects will be initiated including setting up of a new 2400 MW power plant at Pirpainti in Bihar at a cost of Rs 21,400 crore. New airports, medical colleges and sports infrastructure will be built in Bihar. The Bihar government’s requests for external assistance from multilateral development banks will be processed expeditiously.

The government has made efforts to fulfil the commitments in the Andhra Pradesh Reorganisation Act. Recognising the capital requirement of the state, special financial assistance will be facilitated through multilateral agencies. An amount of Rs 15,000 crore will be arranged in the current financial year with additional amounts in future years.

The limit of Mudra loan will be increased from Rs 10 lakh to Rs 20 lakh.

The trade limit for mandatory inclusion of buyers on the TRADES platform will be reduced from Rs 500 crore to Rs 250 crore. Financial assistance will be provided for setting up 50 multi-product food irradiation units in the MSME sector. E-commerce export centres will be set up in PPP mode to enable MSMEs and traditional artisans to sell their products in international markets.

1000 ITIs will be upgraded in 5 years under a hub and spoke arrangement. The focus will be on outcomes and quality in collaboration with states and industries.

India’s top companies will provide skill training to 1 crore youth in 5 years. A 12-month Prime Minister’s Internship will be introduced with a stipend of Rs 5000 per month.

Rs 3 lakh crore is being allocated for schemes benefiting women and girls. Polavaram irrigation project will be completed to ensure food security of the nation.

Funds will be provided for necessary infrastructure in Kopparthi area in Visakhapatnam-Chennai Industrial Corridor and Orvakal area in Hyderabad-Bengaluru Industrial Corridor.

The government has announced that a rental housing scheme will be launched for people working in industries. Under this, dormitories will be built for them to live in.

Pradhan Mantri Janjati Unnat Gram Abhiyan will be launched to improve the socio-economic condition of tribal communities.

To facilitate term loans to MSMEs, a credit guarantee scheme will be launched. This scheme will work on reducing the credit risks of MSMEs. There will be a Self-Finance Guarantee Fund, which will provide cover of up to Rs 100 crore to each applicant, while the loan amount can be higher than this.

An industrial hub will be developed in Gaya in the Amritsar Kolkata Industrial Corridor. Patna-Purnia Expressway, Buxar-Bhagalpur Expressway will be developed at a total cost of Rs 26,000 crore. Along with this, road work in Bodh Gaya, Rajgir, Vaishali and Darbhanga will be expedited. A new 2 lane bridge will be built on the Ganga River in Buxar.

The government will develop tribal areas. Under this, 63000 villages will be developed.

Special focus will be given to MSMEs and manufacturing, especially labour-intensive manufacturing.

A provision of Rs 15,000 crore has been announced for Andhra Pradesh in the budget.

More than 100 branches of India Post Payments Bank will be launched in the North Eastern region.

3 crore additional houses will be built under the Pradhan Mantri Awas Yojana. These will be in both rural and urban areas.

On the education loan front, the government will provide financial assistance for loans up to Rs 10 lakh for higher education in domestic institutions.

The participation of women in the workforce will be increased. Under this, hostels will be built for women workers.

1 month salary support to all employees entering the workforce

This scheme will benefit 2.1 crore youth. Apart from this, the government will provide Rs 3,000 per month to companies for EPFO contribution. First time job holders will be given a help of Rs 15,000 under Direct Benefit Transfer.

The government will implement 3 schemes for employment-related incentives as part of the Prime Minister’s package. These will be based on enrollment in EPFO and will focus on recognising first-time workers and providing support to employees and employers.

109 new high yielding and climate resilient varieties of 32 field and horticultural crops will be released for cultivation by farmers. In the next 2 years, 1 crore farmers will be engaged in natural farming supported by certification and branding. The allocation for agriculture and allied sectors this year is Rs 1.52 lakh crore.

Budget 2024-25 has 9 key priorities, which include increasing agricultural productivity, employment and skill development, inclusive human resource development, manufacturing, energy security, infrastructure, innovation and next generation reforms.

The theme of the budget has been kept in mind for the entire year and beyond. The focus of the budget will be on employment, middle class, MSMEs, agriculture and skilling.

Pradhan Mantri Garib Kalyan Yojana has been extended for 5 years, which has benefited 80 crore people.

As mentioned in the interim budget, we need to focus on the poor, women, youth and farmers. Our aim is to fulfill the aspirations of every Indian.

India’s economic growth is good and it is expected to remain good in the future as well. We are getting closer to the inflation target of 4 percent. Our focus is on inclusive growth. With this thinking, our fight against inflation continues.