Small Saving Schemes Interest Rates: The Central Government has not given any gift on the interest rates of small savings schemes and has kept the interest rates stable for the April-June quarter.

Small Saving Schemes Interest Rates: The Central Government has not given any gift on the interest rates of small savings schemes and has kept the interest rates stable for the April-June quarter. Today, on March 8, the Central Government has not made any change in the interest rates for the first quarter April-June of the upcoming financial year 2024-25. This is the first time in 7 consecutive quarters that the government has not increased the interest rates on these savings schemes.

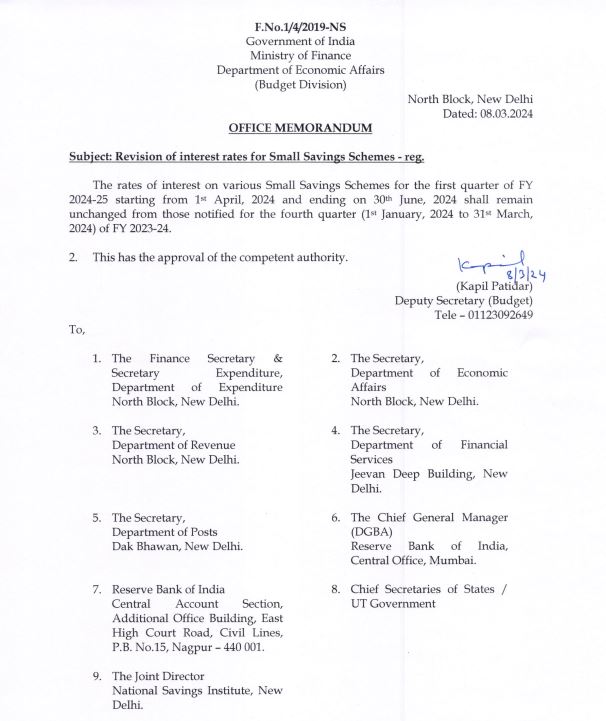

Government notification has been released

A government notification said that interest rates on many small savings schemes will remain unchanged for the first quarter of the financial year 2024-25, starting from April 1, 2024, and ending on June 30, 2024. This means that just as the rates were notified for the fourth quarter from January 1, 2024 to March 31, 2024, the interest rates will continue for the first quarter of the financial year 2024-25 also. It has received the approval of the competent authority.

Know the interest rates of small schemes

Name of Small Saving Scheme Interest Rates

- Sukanya Samriddhi Scheme 8.2 percent

- Senior Citizen Saving Scheme 8.2 percent

- National Saving Certificate 7.7 percent

- Public Provident Fund 7.1 percent

- Kisan Vikas Patra 7.5 percent (115 months)

- Monthly Income Account 7.4 percent

Know the interest rates from savings accounts to other small schemes

Name of Small Saving Scheme Interest Rates

Saving Deposit 4%

1 Year Time Deposit 6.9%

2 Year Time Deposit 7.0%

3 Year Time Deposit 7.1%

5 Year Time Deposit 7.5%

5 Year Recurring Deposit 6.7%

Why small savings schemes were left without changes

Small savings interest rates, however, are set by the government and range from 0-100 basis points based on the yields on government securities of comparable maturity. In such a situation, when the market yield on government securities falls, interest rates on small savings schemes should also be reduced. However, small savings interest schemes for Q2 2024 have been left unchanged despite the fall in government bond yields.