HDFC Bank has increased the MCLR (Marginal Cost of Lending) by 25 basis points. This will have an effect on all types of loans. Those who have taken loan from HDFC Bank, their current EMI will increase.

HDFC Bank , the country’s largest private sector bank , has increased the Marginal Cost of Lending ( MCLR ) by 25 basis points. This will have an effect on all types of loans. Those who have taken loan from HDFC Bank, their current EMI will increase.

MCLR is the interest rate on the basis of which the interest rate of the bank is decided. The interest rate for any loan cannot be less than that. Earlier, HDFC i.e. Housing Development Financial Corporation has increased the interest rate on Home twice this month. HDFC has first increased the RPLR (Retail Prime Lending Rates) by first 5 basis points and then by 30 basis points.

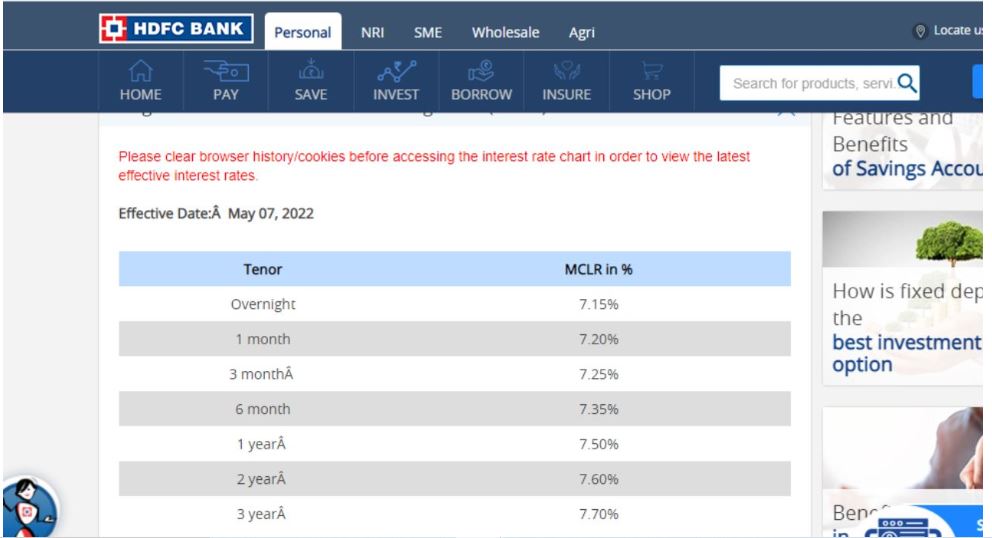

After this increase, the MCLR of HDFC Bank has increased from 7.15 percent to 7.70 percent. Earlier it was between 6.90 per cent to 7.45 per cent. According to the information available on HDFC Bank’s website, the new MCLR for overnight loans has now increased to 7.15 percent.

For one month it is 7.20 per cent, for three months it is 7.25 per cent and for six months it is 7.35 per cent. For 1 year it is 7.50 per cent, for 2 years it is 7.60 per cent and for 3 years or more it is 7.70 per cent. The new rate has come into effect from 7 May.

Many banks have already increased MCLR

Recently, many banks have increased the MCLR. SBI had increased the MCLR by 10 basis points. Apart from this, many banks like Axis Bank, Kotak Mahindra Bank, Bank of Baroda, Yes Bank have increased the MCLR. Explain that the interest rate decision for most loans is based on the 1-year MCLR.

HDFC raised interest rate on home loans twice in a week

Last week, Housing Development Finance Corporation (HDFC) increased the interest rate on home loans twice. HDFC has decided to increase the Retail Prime Lending Rate (RPLR) for home loans by first 5 basis points and then by 30 basis points. The new rate has come into effect from 9 May 2022.

Now the minimum home loan interest rate of the bank will be 7 percent and the maximum interest rate will be 7.45 percent. Earlier on May 1, HDFC had increased the RPLR. This increase was done by 5 basis points, after which the minimum interest rate increased to 6.75 percent. After the new increase, it has now become 7 percent.