New Tax Regime: The Finance Minister has once again praised the new tax regime. He said that after this new system, people do not need to pay any tax on income of Rs 7.27 lakh.

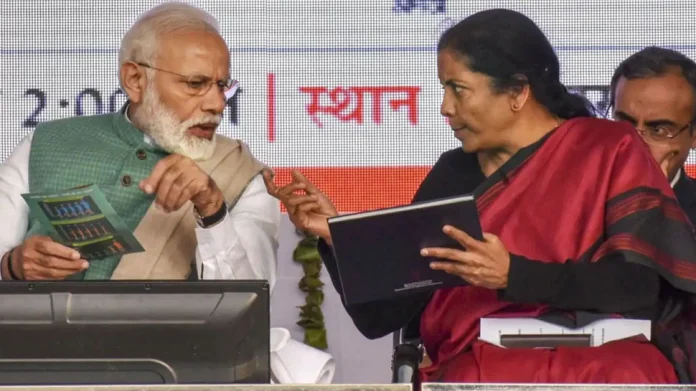

New Tax Regime: In the budget 2023-24, the Modi government at the center has made many changes to make the new tax regime attractive. Since then, the interest of many people has increased in this tax regime. On Friday, Finance Minister Nirmala Sitharaman has once again praised the new tax regime. The Finance Minister said that the new tax regime has given maximum relief and benefits to the middle class people. He said that people of this class are getting tax exemption on an annual income of Rs 7.27 lakh.

Those earning a little more than Rs 7 lakh will also get tax exemption

The Finance Minister has said that the Modi government at the Center is trying to take every section of the country along. In such a situation, keeping in mind the middle class of the country, the government has given income tax exemption to people earning up to Rs 7 lakh. This exemption is available under the new tax regime. After this decision of the government, many people of the country did not believe in it. There was a question in the mind of some people that if a person’s income is more than Rs 7 lakh, will he have to pay tax? In such a situation, we talked continuously to consider this matter. After this, it was decided that no tax would have to be paid if the income is just a little more than Rs 7 lakh. For example, a person earning Rs 7.27 lakh annually will not have to pay any tax.

Standard deduction available on income of Rs 50,000

Nirmala Sitharaman also said that earlier people were not getting the benefit of standard deduction in the new tax regime, about which many complaints were coming. In such a situation, keeping in mind the needs of the people, we have also made a provision for standard deduction up to Rs.50,000.

The budget for MSMEs has been increased manifold

Praising the steps taken by the government for Micro, Small and Medium Enterprises, the Finance Minister said that its budget has increased 7 times in the last 9 years. In the financial year 2013-14, this budget was Rs 3,185 crore, which has now been increased to Rs 22,138 crore in 2023-24. This shows how committed the government is to promote the small industries of the country. Along with this, he said that under the public procurement policy, the government is making 33 percent of the total purchases from MSMEs.