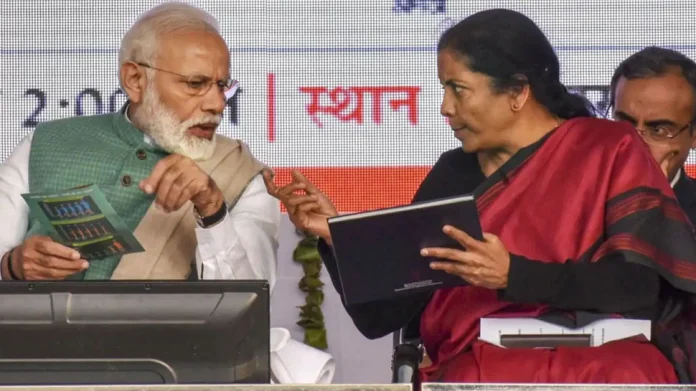

Income Tax Slab: The system of new tax regime was started by the Modi government. At the same time, in the budget 2023, many important announcements were made by Finance Minister Nirmala Sitharaman.

In these announcements, two important announcements were also made by Finance Minister Nirmala Sitharaman regarding the new tax regime, due to which taxpayers are going to get a lot of benefits.

Income Tax Return: Income tax return has to be filed by those people, whose income is more than taxable income. If someone’s annual income is more than the taxable income, then they have to file income tax return. At the same time, many types of tax exemptions are also being given by the government on filing income tax returns. In this sequence, the Modi government has given relief to the people by giving two new benefits in the new tax regime. Let’s know about it…

Two new announcements

The system of new tax regime was started by the Modi government. At the same time, in the budget 2023, many important announcements were made by Finance Minister Nirmala Sitharaman. In these announcements, two important announcements were also made by Finance Minister Nirmala Sitharaman regarding the new tax regime, due to which taxpayers are going to get a lot of benefits.

Tax exemption on such income

Presenting the Budget 2023, Finance Minister Nirmala Sitharaman increased the tax slabs in the new tax regime, as well as increased the tax filing limit. Along with this, if a taxpayer files ITR from the new tax regime, then he will not have to pay any tax on an annual income of Rs 7 lakh. Along with this, if someone’s annual income is up to seven lakh rupees, then he will not have to pay tax under the new tax regime.

Standard deduction

Along with this, another important announcement has been made in Budget 2023 by Finance Minister Nirmala Sitharaman. Earlier, people did not get the benefit of standard deduction in the new tax regime. But while presenting the Budget 2023, it was announced by Nirmala Sitharaman that from now on even in the new tax regime, salaried and pensioners will get the benefit of standard deduction of Rs 50,000.

People got relief

In such a situation, tax exemption on annual income up to Rs 7 lakh and with the help of standard deduction of Rs 50 thousand, people will not have to pay any tax on annual income of Rs 7.5 lakh. With these two announcements, people will get a lot of relief in filling ITR.