Income Tax Payment: If you have not yet deposited your income tax, then now you can do this work through phone pay. We are telling you about its entire process.

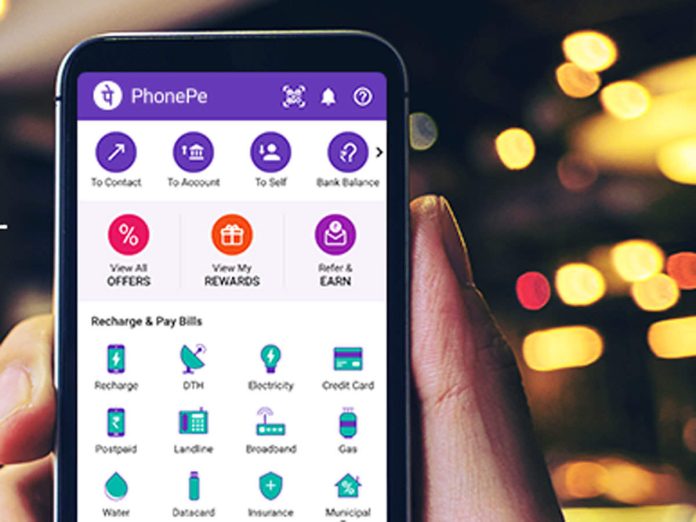

ITR Filing Through PhonePe: The last date for filing Income Tax Return for FY 2022-23 and Assessment Year 2023-24 is getting closer. The Income Tax Department is repeatedly advising people to file ITR within the deadline. On the other hand, if you have not yet deposited income tax, then you can easily do this work from the country’s big digital payment app Phone Pay. PhonePe has announced that it is launching the service of the Income Tax Department. Through this service, both salaried individuals and businesses can deposit their taxes. The biggest advantage of depositing tax through PhonePe is that you will not even have to login to the tax portal for this.

Partnership between PhonePe and PayMate

PhonePe has partnered with PayMate, a digital payment and service provider, to facilitate income tax filing. After this partnership, both salaried individuals and business people can pay their tax for the financial year 2022-23. Giving information about this facility, PhonePe has said that now taxpayers will get rid of the hassle of login to file ITR and they will be able to deposit tax easily. Along with this, taxpayers can now take advantage of an interest-free period of 45 days by depositing tax through their credit cards. Once the tax is deposited, they will get the Unique Transaction Reference (UTR) number within one working day. At the same time, the challan of tax payment will be received within two working days.

How to file ITR on PhonePe

- For this, open the Phone Pe app and select the Income Tax option.

- After this, enter the amount of tax you want to deposit, assessment year and PAN card details.

- Then enter the desired amount and select the mode of payment option.

- After this, you will get the portal UTR number within two working days after making the payment, which should be updated on the portal.

Tax payment made easy

Launching the tax payment feature on Phone Pe, Phone Pe has said that paying income tax has always been a difficult process. In such a situation, Phone Pe has provided taxpayers an easy way to make a tax payment. After tax payment, users will get the UTR number within two days, whose information can be updated on the Income Tax Portal. Keep in mind that you can deposit income tax only through phone pay, but you will have to submit the return by visiting the portal itself.