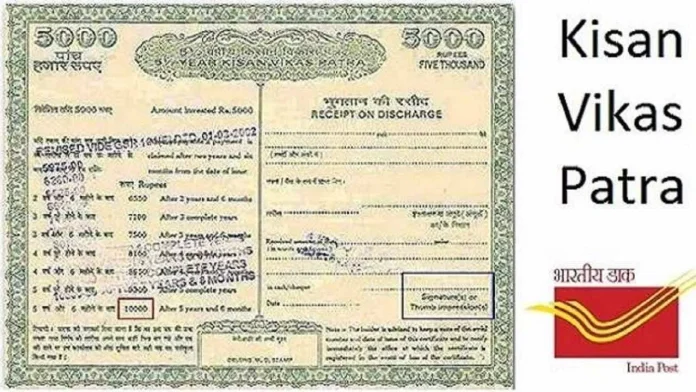

Kisan Vikas Patra (KVP) is a Government Small Savings Scheme backed by the government. This scheme is designed to double your investment in a fixed period. A certificate is issued to the investor and the investment amount is doubled at the time of maturity (Kisan Vikas Patra Double your Money).

The aim of this scheme is to promote long-term investment without risk among the common people so that more and more people can save money for their future. KVP can be purchased from post offices and select banks. In which the minimum investment is Rs 1,000 and there is no upper limit of investment.

How much time does it take for the money to double under KVP?

The time period in which your investment will double through Kisan Vikas Patra will depend on the interest rate at the time of your investment. Currently, this government scheme is offering a guaranteed return of 7.5%. This means that your invested amount will double in about 115 months i.e. 9 years and 7 months. The period for doubling your investment is linked to the interest rate announced by the government, so it is important to check the current rates before investing.

Initially launched for farmers, this scheme is now open to all, offering guaranteed returns on investment. With minimal risk and fixed interest rate, KVP is a good investment option for those who want to double their investment over time. Let’s know about this scheme in detail.

Key features of Kisan Vikas Patra

Guaranteed returns: Your investment will double after a specified period.

Fixed interest rate: Its interest rate is revised by the government from time to time, but once you invest, the interest rate remains fixed for your entire investment period. That is, the interest rate at the time of your investment will remain applicable for the entire investment period, even if the interest rate increases or decreases later.

Security: KVP is a Government of India scheme, which makes it one of the safest investment options.

Minimum investment: You can start investing from Rs 1,000 and there is no upper limit on investment.

Premature withdrawal: While the money is locked for a specified period, premature withdrawal is allowed under certain conditions, such as death or court order.

How to Buy Kisan Vikas Patra (KVP)?

You can buy KVP from any post office or select banks across India. Below is a step-by-step process on how you can buy KVP.

Visit a post office or bank: KVP certificates are available for purchase at any post office and select banks.

Fill the application form: You need to fill a KVP application form and provide your Aadhaar card or PAN card as identity proof.

Make payment : You can invest a minimum of Rs 1,000 in KVP and can increase it in multiples of Rs 1,000.

Certificate : Once your payment is processed, you will receive a KVP certificate as proof of your investment. You can choose the option of a physical certificate or an electronic certificate (eKVP) as per your convenience.

Benefits of Kisan Vikas Patra

- Low Risk, High Security: Since KVP is backed by the Government of India, your investment in it is safe.

- Investment doubling guarantee: Irrespective of market conditions, your investment will double in a specific period.

- No upper investment limit: Unlike other government schemes, there is no upper investment limit on investments in KVP, making it a great option for big savings.

- Premature withdrawal facility: Even though it is a long term investment, KVP offers the flexibility to withdraw in emergencies.

- Easy to transfer: KVP certificates can be easily transferred from one person to another and from one post office to another.

Drawbacks of Kisan Vikas Patra

Taxable returns: The interest earned on KVP is fully taxable, and unlike other savings schemes, it does not offer any tax benefit under section 80C.

Lock-in Period: This scheme has a lock-in period of 2.5 years, which means that except under special circumstances, you cannot withdraw your money before this period.

Kisan Vikas Patra is a safe and good investment option for those who want to double their money over time without taking much risk. Due to its guaranteed returns and being a government scheme, it attracts investors who prefer stability over high returns. However, investors need to keep in mind that despite Kisan Vikas Patra being safe, the returns on it are fully taxable, which can affect your overall earnings.