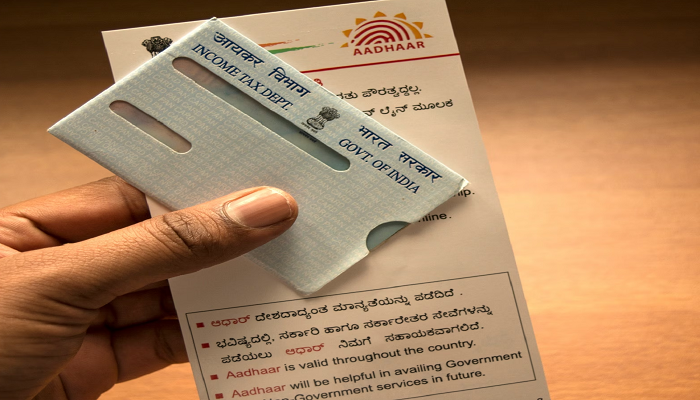

The deadline for PAN-Aadhaar linking has not been extended, but you can still link Aadhaar and PAN. Now you may have to pay more fine than before.

PAN-Aadhaar linking: The deadline for PAN-Aadhaar linking has ended on June 30. Most of the people expected that this time also the deadline for linking would be extended but till now nothing has been said in this regard by the government. Now today i.e. from July 1, for linking of Aadhaar-PAN, more fine may have to be paid than before. Tell that till June 30, an challan of Rs 1000 had to be deducted on the linking of Aadhaar-PAN. However, during this time many people have also faced difficulties. A clarification has been issued by the Income Tax Department for such people.

No need to download challan: Income Tax Department in a tweet said- There have been some cases where PAN card holders have faced difficulty in downloading the challan after paying the fee for Aadhaar-PAN linking. In this connection, it is informed that the status of challan payment can be checked in the ‘e-pay tax’ tab of the portal after login. If the payment is successful, the PAN holder can proceed to link PAN with Aadhaar.

There is no need to download the challan receipt for linking PAN with Aadhaar. Further, as soon as the PAN card holder completes the payment successfully, an email is being sent to the PAN card holder with an attached copy of the challan.

Kind Attention PAN holders!

Instances have come to notice where PAN holders have faced difficulty in downloading the challan after payment of fee for Aadhaar-PAN linking.

In this regard, it is to be informed that status of challan payment may be checked in ‘e-pay tax’ tab of…

— Income Tax India (@IncomeTaxIndia) June 30, 2023

Whose PAN will not be deactivated: However, relief has been given to people in cases where fee payment and consent for linking has been received, but Aadhaar and PAN have not been linked till 30.06.2023. This situation will be considered by the Income Tax Department before deactivating the PAN.

What will happen if it becomes inactive: Tell that those who have not linked PAN with Aadhaar till June 30, 2023, their PAN can become inactive from today i.e. July 1. Being inactive means that you will neither be able to open a bank account nor get an income tax refund. If you understand in simple language, you may face problems in all those work related to finance, in which PAN card is used.

Now what is the next option: Although the government has not extended the linking deadline yet, you can still link Aadhaar and PAN. Now you may have to pay more fine than before. There was a provision to get the linking done by June 30 with a fine of Rs 1000. Explain that to link PAN and Aadhaar card, you have to visit the website of Income Tax e-filing portal https://incometaxindiaefiling.gov.in/.