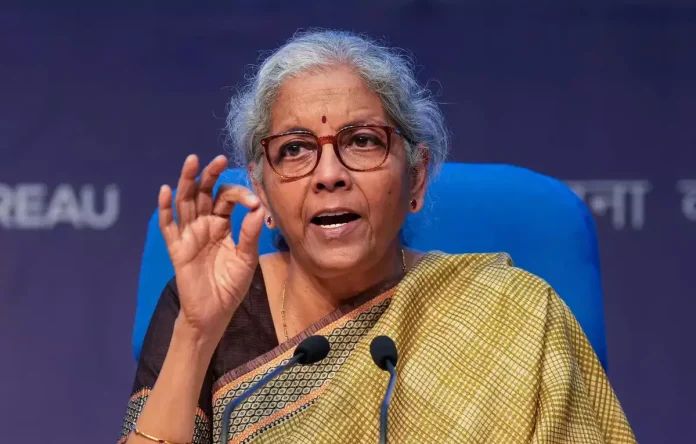

GST Rates: Finance Minister Sitharaman said that the government wants to bring petrol diesel under the ambit of GST but Congress is adopting a dual policy regarding this.

Petrol-Diesel In GST: Finance Minister Nirmala Sitharaman has given an important statement regarding bringing petrol diesel under the ambit of GST. The Finance Minister said that the BJP-led central government has been in favor of bringing petrol diesel under the ambit of GST since the beginning, but the Congress is adopting a dual policy on this.

Finance Minister targets Congress:

Talking to reporters in Indore, Madhya Pradesh, the Finance Minister said that the BJP government at the Center wants to bring petrol diesel under the ambit of GST but Congress is adopting a ‘double standards’ on this subject. The Finance Minister said that the media should question the Congress which has a ‘double standards’ in the matter of bringing petrol and diesel under the ambit of GST. He said that his government is in favor of bringing petrol and diesel under the ambit of GST from the very beginning because this step will benefit the public, but the right to decide in this matter rests with the GST Council.

Congress should give consent in GST Council

Nirmala Sitharaman targeted Congress General Secretary Priyanka Gandhi Vadra and said, ‘Who are the people who are stopping petrol and diesel from being brought under GST? If Priyanka Gandhi is in favor of bringing petrol and diesel under the ambit of GST, then she should ask every state government of Congress to agree to it in the GST Council meeting.

Tax game on petrol diesel

Let us tell you that at present the Central Government collects excise duty on petrol diesel and the State Government collects VAT i.e. Value Added Tax. For example, if petrol is available in Delhi for Rs 96.72 per liter, then the central government charges excise duty of Rs 19.90 per liter while the state government charges VAT of Rs 15.71. That means the price includes tax of Rs 35.61. Similarly, the price of diesel in Delhi is Rs 89.62 per liter, which includes excise duty of Rs 15.80 per liter collected by the central government, and the state government charges VAT of Rs 13.11 per liter.

Government’s eye on global turmoil

When asked about the impact of the Israel-Hamas war on the Indian economy, the Finance Minister said, ‘Ever since the Russia-Ukraine war started, there has been constant speculation about crude oil prices and we have been dealing with it. . He told that India has imported cheap crude oil from Russia. He said, ‘Be it Russia-Ukraine war or Israel-Hamas war, whenever there is a war in the world, there is a possibility of impact on crude oil prices. We have already been keeping a close eye on the situation.

Inflation is being tightened

Sitharaman said that the government has been taking steps to control the inflation of tomatoes, flour, pulses and other common items for a long time, but in the previous Congress government, the food inflation rate was more than 10 percent for 22 months. He said that the Congress government could not do anything towards controlling this inflation.