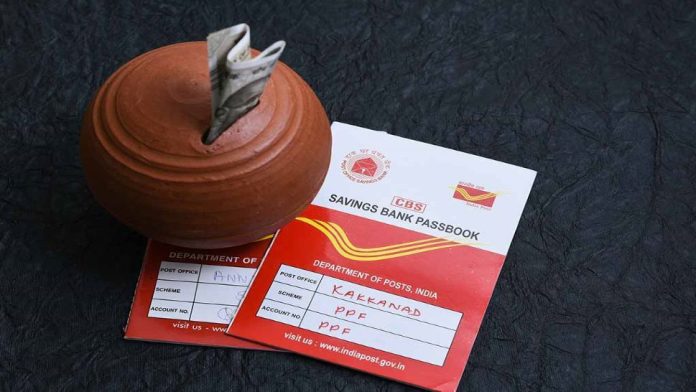

Post Office Life Insurance Plan: Postal Life Insurance (PLI) ie known as Postal Life Insurance, it was started on 1 February 1884 in the British period.

Whole Life Assurance Plan: If you invest in post office scheme, then you can increase your money quickly by investing in Whole Life Assurance-Security Scheme. Because like the bank, many types of saving schemes are run in the post office too. Facilities like RD and Fixed Deposit are available from savings account. Postal Life Insurance ( PLI) is known as Postal Life Insurance . You will be surprised to know that PLI is the oldest government insurance scheme. It was started on 1 February 1884 in the British era.

The age limit for buying Whole Life Assurance-Security Policy has been fixed from 19 years to 55 years. Under this scheme, the policy holder gets a minimum of Rs 20,000 with bonus and a maximum of Rs 50 lakh as sum assured after the age of 80 years. If the policy holder dies in the meantime, then this amount is given to his successor or nominee.

Loan facility is available

In this scheme, after running the policy continuously for 4 years, the policy holder is also given the facility to take a loan on it. If you are not able to run the policy for a long time, then you can also surrender it after 3 years. But if you surrender it before 5 years, then you will not get the benefit of bonus on it. On surrender after 5 years, proportionate bonus is paid on the Sum Assured.

You also get the benefit of tax exemption

In this scheme of the post office, the policy holder also gets the facility of tax exemption. You can get exemption under section 80C of the Income Tax Act for the premium paid in Postal Life Insurance. In this plan, you are given the option of monthly, quarterly, half-yearly and yearly for the payment of premium. You can choose the option as per your convenience.

Not only this, if you wish, you can convert this policy into Endowment Assurance Policy till the age of 59 years, provided the date of conversion is the date of completion of premium payment or the date of maturity. Should not happen within a year. Apart from this, you can get the policy transferred to any part of the country.

Only 50 rupees will have to be deposited daily

If you invest in this post office plan at the age of 20, then for maturity of 50 years you will have to pay Rs 1666 plus GST as premium every month, whereas for 55 years it will be Rs 1515, 58 Rs 1436 for the year and Rs 1388 will have to be paid as premium every month for maturity of 60 years. If the policy holder decides the age of 60 years for the maturity of the scheme, then he will have to pay a monthly premium of Rs 1388 for the next 40 years, which is less than Rs 50 per day.

This is how calculation is done

In this plan, at present, Rs 60 per 1,000 sum assured is being given as annual bonus by the post office. Calculating according to this, 60 thousand rupees will be deposited as annual bonus on the sum assured of 10 lakhs. In this way, for the next 40 years, at the rate of 60 thousand rupees per year, about 24 lakh rupees will be deposited as bonus. In such a situation, when the plan matures, the person investing will get a bonus of Rs 24 lakh and a sum assured of Rs 10 lakh, which adds up to Rs 34 lakh.

Who will get the benefit of this scheme

Earlier, only government and semi-government employees could take advantage of this policy, but after the year 2017, doctors, engineers, lawyers, management consultants, chartered accountants, architects, bankers and employees etc. can take advantage of all insurance policies run under PLI. Has also been made available for If you want to take advantage of this scheme, then you can buy it online.