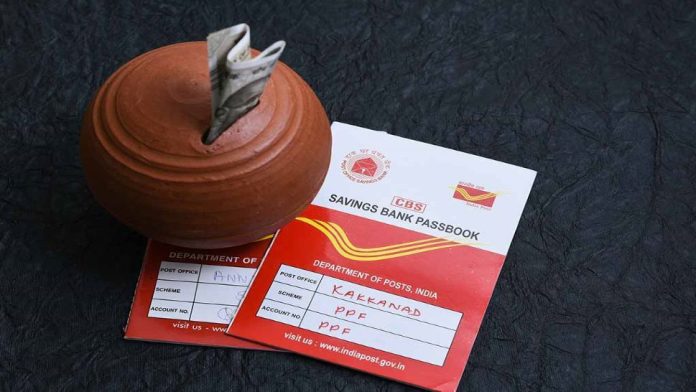

Post Office Scheme: By investing in the plan of Post Office, you can invest in yourself and your family.

- The Future Of The Family can be secured. Also good returns are also available on them.

- Today we are telling you about one such investment plan of Post Office.

- This is the most profitable investment plan of Post Office.

14 lakhs will be available on investment of Rs 95:

- Advertisement -

- Let us tell you that in this scheme, you have to invest only 95 rupees and you can get a fund of 14 lakh rupees on maturity.

- If you have not got this policy done then you can still do it. Let’s know about this scheme.

- The benefit of money back is available in the policy:

Let us inform that this scheme of Post Office is for the people living in rural areas.

Its name is ‘Gram Sumangal Rural Postal Life Insurance Scheme’.

- In this scheme (Gram Sumangal Rural Postal Life Insurance Scheme), you can save Rs 95 daily and get up to Rs 14 lakh.

- On staying, the benefit of Money Bank is also available, that is, the amount you invested will be fully refunded.

Age limit for taking policy:

- Let us tell you that in ‘Gram Sumangal Rural Postal Life Insurance Scheme’, the policyholder also gets the Maturity Bonus on maturity.

- This scheme (Gram Sumangal Rural Postal Life Insurance Scheme) can be taken for 15 years and 20 years.

- At the same time, the age limit for taking the policy of ‘Gram Sumangal Rural Postal Life Insurance Scheme’ is from 19 years to 45 years.

- The special thing is that any Indian citizen can take advantage of this.

Bonus on Maturity:

- Let us tell you that the person in whose name the policy is in his name gets Sum Assured up to Rs 10 lakh.

- For example, if a person survives till the maturity of the policy, then he gets the benefit of money back.

- This benefit of Money Bank is available 3 times. Under this, 20-20% Money Bank is available on completion of 06 years, 09 years and 12 years in a 15-year policy.

- At the same time, the remaining 40 percent money is also given including the Maturity Bonus on maturity.

Benefit of money back on 20 years:

- Those who take a policy of 20 years, they get money back at the rate of 20-20% on the tenure of 8 years, 12 years and 16 years.

- The remaining 40 percent money is given on maturity with bonus.

- At the same time, on the death of the policy holders, the Nominee is given the sum insured as well as the bonus amount.

Installment will come like this:

- Let us tell you that if a person of 25 years takes this policy for 20 years with a sum assured of Rs 7 lakh, then an installment of Rs 2853 will have to be paid every month.

- That is, about 95 rupees will have to be saved daily. In this case, the annual premium will be Rs 32735.

- If someone wants to pay it in 06 months, then it will become an installment of Rs 16715 and Rs 8449 in three months.

Bonus will make Lakhpati:

- Let us inform that in this policy of the Post Office, 1.4-1.4 lakh rupees will be available in the 8th, 12th and 16th year at the rate of 20-20%.

- At the same time, in the 20th year, the benefit of Sum Insured of Rs 2.8 lakh will be available.

- In this, an annual bonus of Rs 48 per thousand will be added, which will be Rs 33600.

- On the other hand, a bonus of Rs 6.72 lakh was made in a period of 20 years.

- On adding all the installment and bonus amount, you will get a profit of about Rs 13.72 lakh.

- Advertisement -