Public Provident Fund Investment: If you are doing retirement planning or want to earn good income from long term investment then you can choose this scheme. The scheme is more popular by the name of PPF.

Public Provident Fund Investment: Most of the people want to become Crorepati and are looking for that money should be invested in a place where there is huge profit. But, how much will be the income from investment and if you want to stay out of the purview of Income Tax, then Public Provident Fund (PPF) removes this concern. Good return on investment and tax saving option is available in the scheme. If you are doing retirement planning or want to earn good income from investment in long term, then you can choose this scheme. The scheme is more popular by the name of PPF.

Why is PPF considered the best option?

Public Provident Fund (PPF) is most popular because the money deposited in it, the interest received and the amount received on maturity (PPF Maturity) are completely tax free. Meaning it is kept in the EEE category. EEE stands for Exempt. There is an option to claim tax exemption on deposits every year. No tax has to be paid on the interest received every year. Once the account matures, the entire amount will be tax free.

Who can invest in PPF?

Small Savings Scheme (Small Savings Scheme) Any citizen of the country can invest in PPF. It can be opened in post office or any bank. A minimum investment of Rs 500 and a maximum of Rs 1,50,000 can be made every financial year. Interest is calculated on an annual basis. However, the interest is fixed on a quarterly basis. At present, 7.1% interest is being received on PPF. The maturity period lasts for 15 years. There is no facility to open joint account in the scheme. However, a nominee can be made. There is no option to open PPF account even in the name of HUF. In the case of children, the name of the guardian is included in the PPF account. But, it remains valid only till the age of 18.

How can PPF really make a millionaire?

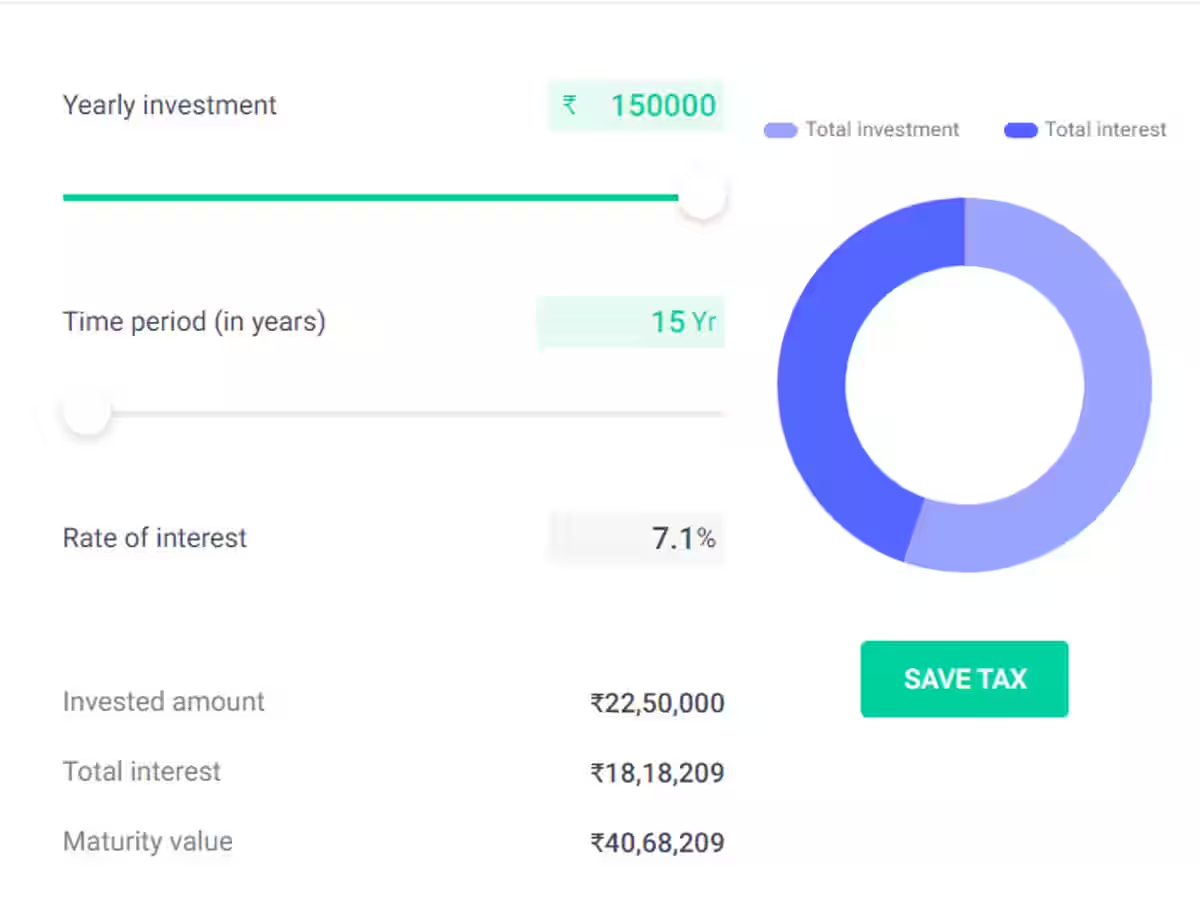

PPF is such a scheme, in which it is easy to become a millionaire. This requires regular investment. Suppose you are 25 years old and you have started PPF. If you deposit Rs 1,50,000 (maximum limit) in the account between 1st to 5th at the beginning of the financial year, then at the beginning of the next financial year only Rs 10,650 will be deposited with interest. That means on the first day of the next financial year your balance will be Rs 1,60,650. By doing the same again next year, the account balance will be Rs.3,10,650. Because, 1,50,000 rupees will be deposited again and then interest will be received on the entire amount. This time the amount of interest will be Rs 22,056. Because, the formula of compound interest works here. Now suppose 15 years of PPF maturity have been completed, then you will have Rs 40,68,209 in your account. In this, the total deposit amount will be Rs 22,50,000 and Rs 18,18,209 will be earned only from interest.

If you want to become a Crorepati then invest even after maturity

PPF was started at the age of 25. At the maturity of 15 years, at the age of 40, an amount of more than Rs 40 lakh is in hand. But if the planning is for a long period, then the money will grow faster. After maturity in PPF, the account can be extended for 5-5 years extension. If the investor extends the PPF account for 5 years, then by the age of 45, the total amount will be Rs 66,58,288. The investment in this will be Rs 30,00,000 and the interest earned will be Rs 36,58,288.

At what age to become Crorepati?

The goal of becoming a millionaire will now be fulfilled. PPF account has to be extended once again i.e. for another 5 years till 25 years. Again an investment of Rs 1,50,000 will have to be made annually. At the age of 50, a total of Rs 1,03,08,014 will be deposited in the PPF account. The investment in this will reach Rs 37,50,000 and the interest will reach Rs 65,58,015.

Earning of interest will cross 1 crore

Understand the second feature of PPF that how many times you can do the extension of 5 years. Now once again if the account is extended for 5 years then at the age of 55 you will have 1 crore 54 lakh 50 thousand 910 rupees. The investment in this will be only Rs 45,00,000, but the interest income will exceed Rs 1 crore and the total income will be Rs 1,09,50,911.

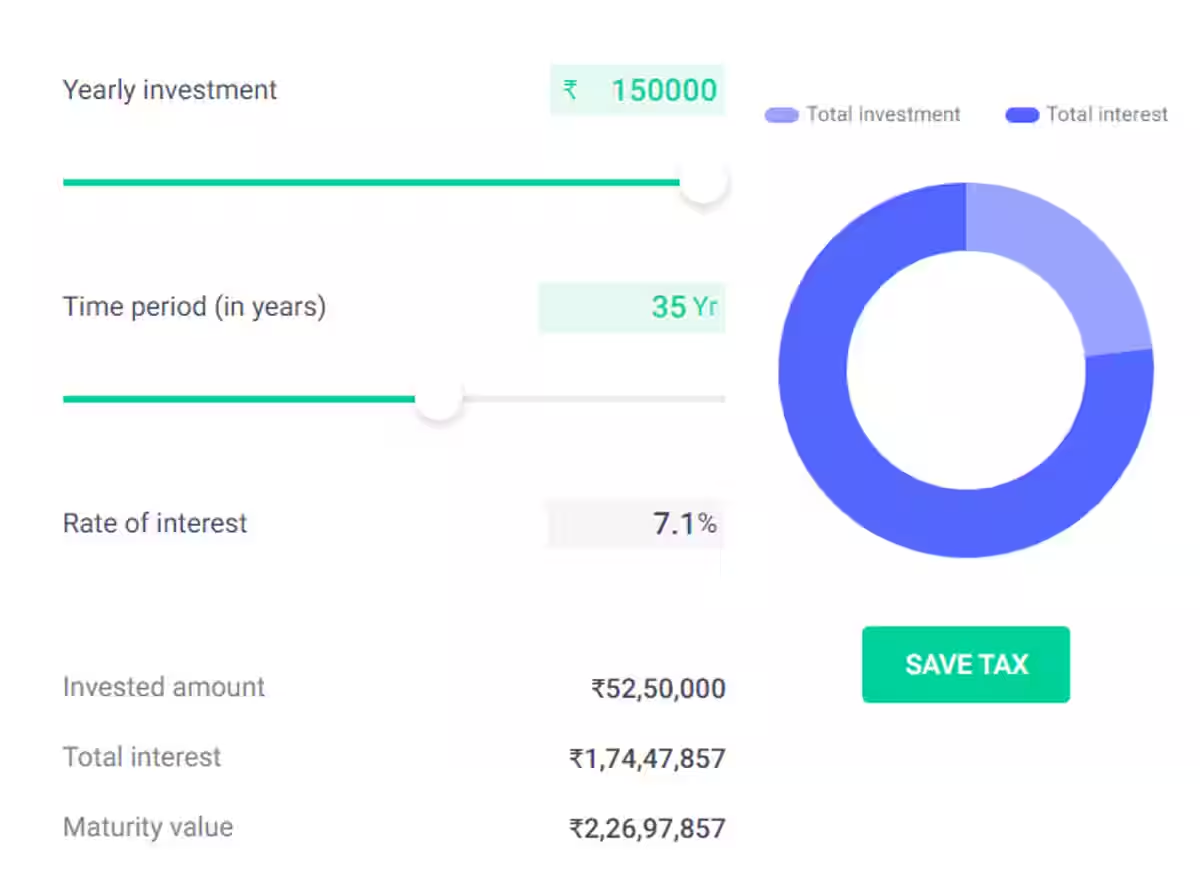

Will invest 2 crore 26 lakh 97 thousand 857 rupees for 35 years

If you have invested in it for retirement, then PPF will have to be extended once again for the last 5 years. That means investment will continue for 35 years in total. In this case, maturity will be at the age of 60. In this case, the total deposit amount in the PPF account will be Rs 2 crore 26 lakh 97 thousand 857. The total investment in this will be Rs 52,50,000, while the income from interest will be Rs 1 crore 74 lakh 47 thousand 857.

If you want to double your money then invest like this

When you retire at the age of 60, there will be no tax on the huge amount deposited in PPF above 2 crores. Usually, if you earn such a huge amount from somewhere else, then you will have to pay heavy tax on it. If both husband and wife run PPF account together for 35 years, then the total balance of both will be Rs 4 crore 53 lakh 95 thousand 714.