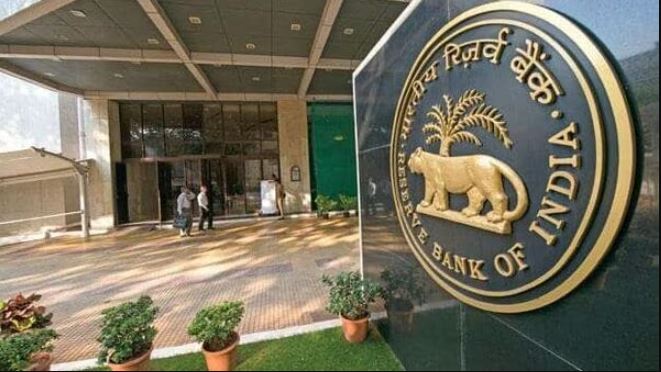

The Reserve Bank of India (RBI) has imposed a fine of Rs 59.20 lakh on South Indian Bank. The bank gave this information on Friday. The fine has been imposed due to lack of compliance with certain instructions on interest rates on deposits and customer service in banks.

RBI said that the bank imposed penalty charges for not maintaining minimum balance / average minimum balance without informing some customers through SMS / e-mail or letter. South Indian Bank has also marked claims on some NRE savings deposit accounts.

The Reserve Bank of India had conducted an inspection for supervisory evaluation of South Indian Bank with regard to its financial position as on March 31, 2023. A notice was issued to South Indian Bank Limited on the basis of non-compliance with RBI’s instructions and related correspondence. After considering the bank’s reply to the notice and the oral submissions made during the personal hearing, RBI found that the allegations leveled against the bank are correct, which warrants imposition of monetary penalty.

RBI said that this penalty is based on deficiencies in statutory and regulatory compliance and is not intended to affect the validity of any transaction or agreement entered into by the bank with its customers.

Profit up 18% in Q2

South Indian Bank’s net profit in the July-September 2024 quarter rose 18.15 per cent year-on-year to Rs 324.69 crore. Profit stood at Rs 274.81 crore a year ago. Operating profit rose 19.51 per cent year-on-year to Rs 550.25 crore from Rs 460.44 crore in the September 2023 quarter. Gross NPA declined 56 bps year-on-year to 4.40 per cent in the September 2024 quarter from 4.96 per cent a year ago. Net NPA declined 39 bps to 1.31 per cent from 1.70 per cent a year ago.