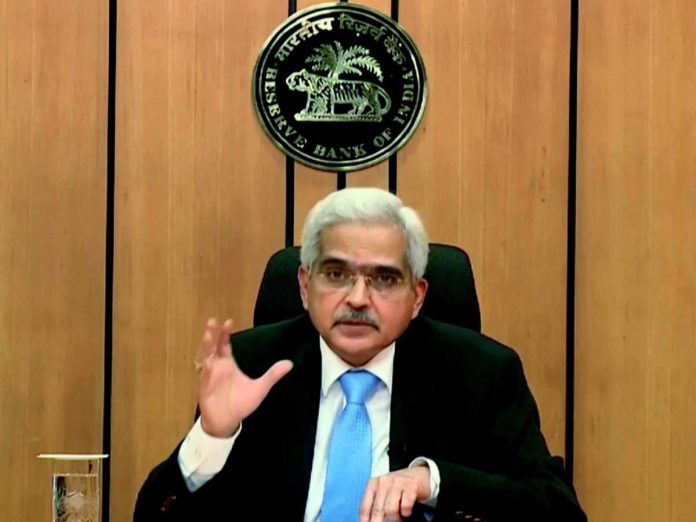

RBI has put many curbs on Nagar Urban Co-operative Bank Ltd. Under these restrictions, the withdrawal limit for the customers of the bank from their accounts has been fixed at Rs 10,000. The central bank has taken this step in view of the deteriorating financial condition of the bank.

The Reserve Bank of India (RBI) has imposed several curbs on Nagar Urban Co-operative Bank Limited, Ahmednagar, Maharashtra. Under these restrictions, the withdrawal limit for the customers of the bank from their accounts has been fixed at Rs 10,000. The central bank has taken this step in view of the deteriorating financial condition of the bank.

These restrictions under the Banking Regulation Act (Applicable to Co-operative Societies), 1949 will remain in force for a period of six months from the close of business hours on December 6, 2021 and will be reviewed.

The central bank has said that the bank will neither give any loan or advance nor renew any loan without its permission. Along with this, the bank will also be prohibited from making any kind of investment, taking any kind of liability, payment and transfer or sale of properties.

The Reserve Bank said that the customers of the bank will not be able to withdraw more than Rs 10,000 from their savings bank or current accounts. A copy of the Reserve Bank’s order has been placed in the bank premises so that customers can get information about it. However, the central bank has clarified that these restrictions should not be construed as cancellation of banking licences.

RBI imposed penalty on Vasai Co-operative Bank

Earlier in October, the Reserve Bank had imposed a fine of Rs 90 lakh on another Maharashtra-based bank Vasai Vikas Sahakari Bank for non-compliance of certain instructions.

These include classification of loans as bad loans (NPA) and other instructions. The central bank had said in the statement that the bank has not complied with its instructions to ensure end use of funds in borrowal accounts and classification of loans as non-performing assets.

The bank also did not comply with the RBI’s specific directive to ensure that the books of account and profit and loss account of the bank are signed by at least three of its directors.

The central bank said that as on March 31, 2019, this disclosure was made after examining the statutory inspection of the bank, its inspection report and all related correspondence with regard to the financial position of the bank.