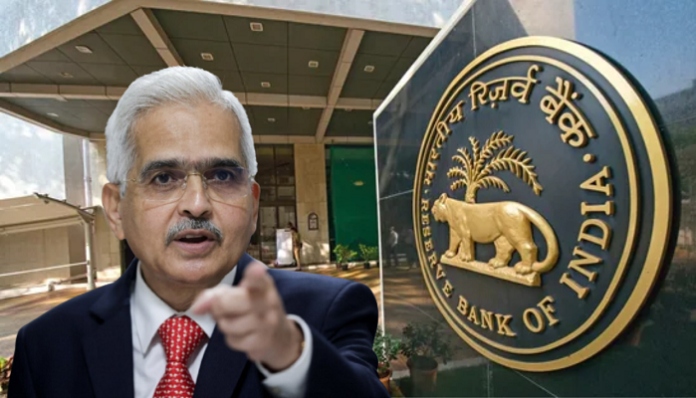

The Reserve Bank of India has imposed a penalty of lakhs on four cooperative banks. Of these, 3 banks are from Maharashtra and one is from Bihar.

RBI Imposed Monetary Penalty: The Reserve Bank of India has once again taken strict action against four banks. Monetary penalty has been imposed on four co-operative banks for violating norms. Three banks from Maharashtra and one from Bihar are included in this list. RBI has given this information through a press release on 10 August i.e. today.

Fine imposed on these banks of Maharashtra

All three from Maharashtra have been fined for similar reasons. These banks failed to comply with the directions on “Maintenance of Deposit Accounts” and KYC, issued by RBI. A penalty of one lakh has been imposed on Mangal Co-operative Bank (Mumbai). A monetary penalty of Rs 2 lakh each has been imposed on The Mahabaleshwar Urban Co-operative Bank and The Islampur Co-operative Bank Ltd.

Fine imposed on this bank of Patna

The Central Bank has imposed a penalty of Rs 1 lakh on The Tapindu Urban Co-operative Bank located in Patna, the capital of Bihar. The bank failed to comply with the direction issued by RBI on “Exposure Norms and Statutory/Other Restrictions on UCBs”. Explain that the Reserve Bank has taken action on all banks under Section 47A (1) (C), Section 56 and Section 46 (4) (i) of the Banking Regulation Act, 1949.

Will customers also be affected?

The Central Bank has also clarified that the penalty has been imposed on the banks in view of the deficiencies. Transactions happening between the customer and the bank will not be affected.