RBI has once again increased the repo rate. The new rates have increased from 5.4 percent to 6.25 percent. Due to this decision, the loan may become more expensive and the EMI burden on the general public may increase.

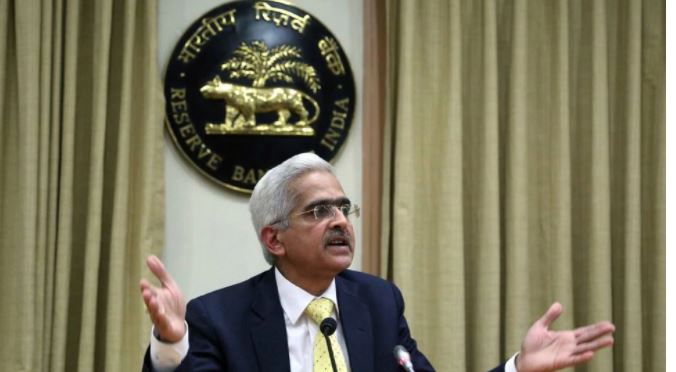

RBI Repo Rate: The Reserve Bank of India has announced an increase in the repo rate even once. This decision has been given after the meeting of the Monetary Policy Committee, which is going on for the last three days under the chairmanship of RBI Governor Shaktikanta Das. In view of inflation, the central bank has increased the repo rate by 0.35 percent. During the meeting, 5 out of 6 people had given permission for this.

Had already increased

Now the new rates have increased from 5.4 percent to 6.25 percent. This will directly affect the general public. Let us tell you that for the fifth time this year, RBI has increased the repo rate. Earlier, the increase was done in October itself. And in May, its rates were increased by 50 basis points, which was increased to 4.90 percent.

Loan will be expensive

Bank loan and EMI are decided on the basis of repo rate, due to which the loan becomes costlier and EMI increases. Even in October, many banks had made their loans costlier. In which SBI, BOE, Punjab National Bank, HDFC Bank and many other big banks were also included.

Asked for inflation and GDP

It is being said that RBI has taken this decision to curb inflation. While announcing the new repo rate, Governor Shaktikanta Das spoke big about inflation. He said that the inflation rate is likely to remain above 4% in the next 4 months. He also talked about the improvement in rural demand and consumer confidence in the country. Further said that the GDP growth in the financial year 2023 could be up to 6.8 percent. According to him, in the first quarter of 2024, the CPI could remain up to 5 percent.

Monetary Policy Committee meeting met on 5th,6th &7th Dec, based on an assessment of macroeconomic situation & its outlook, MPC decided by a majority of 5 members out of 6 to increase policy repo rate by 35 basis points to 6.25% with immediate effect: RBI Governor Shaktikanta Das pic.twitter.com/wX40cSfduV

— ANI (@ANI) December 7, 2022