RBI has asked bank customers to update their KYC in certain cases by submitting fresh documents. Employees can complete the new KYC process using the online Video Based Customer Identification Process (V-CIP).

Reserve Bank of India i.e. RBI has asked the customers of the bank to update their KYC by submitting new documents in some cases. According to the central bank, employees can complete the new KYC process by personally visiting the bank’s branch or by using the online Video Based Customer Identification Process (V-CIP).

In some cases, a fresh KYC process or fresh documents will be required as banks need to update their records. To comply with the PMLA of 2002, the banking regulator has made some changes to make it easier for customers to update their KYC details.

When will KYC be required?

If the documents in the bank’s records do not match with the current list of officially valid documents, a fresh KYC will have to be done. Apart from this, even if the validity of the document submitted earlier has expired, it will be necessary to get a new KYC done. When customers submit their self-declaration or KYC documents, banks must acknowledge the receipt.

Apart from this, even if the customer has changed his residence, he can get his residence address updated through any of the means mentioned above. After this, the bank will verify the revised or updated address within two months of receiving it.

This is how you can do KYC sitting at home

Let us tell you that through video KYC, any customer can open a savings account even while staying at his home or office and will not have to go to the bank for KYC. Video KYC is a quick and easy way to open a savings account. Due to online KYC through this, the time taken to go to the bank branch will be saved.

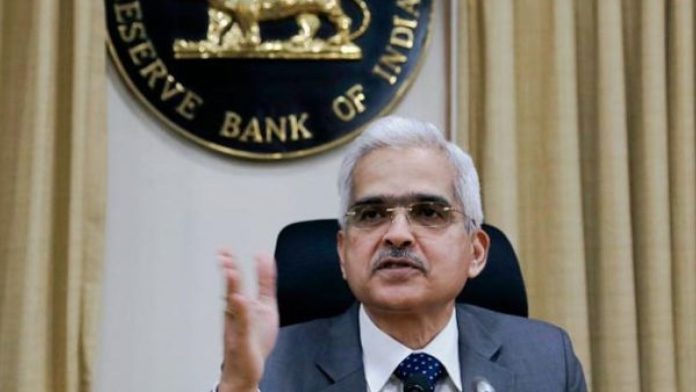

RBI Governor Shaktikanta Das said that now proprietorship firms, authorized signatory and beneficial owners of statutory units will also be eligible for video KYC facility. Along with this, video KYC facility has also been allowed for periodic updation of KYC. Face-to-face mode will no longer be required for KYC after the new rule of RBI. Aadhaar will be authenticated through e-KYC.