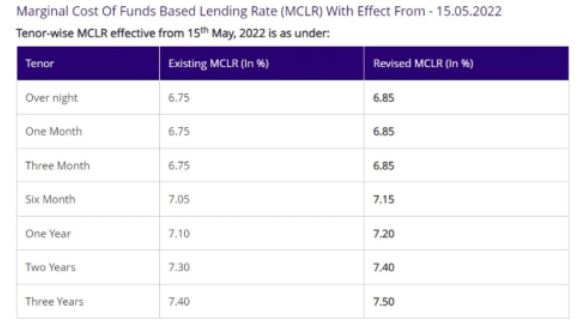

SBI MCLR Hike: SBI has increased the MCLR for the second consecutive time in a month. This will make bank loans expensive. According to the information given on SBI’s website, the changed MCLR rate will be applicable from May 15.

SBI MCLR Hike: State Bank of India (SBI) has once again shocked its customers. The interest rate has been increased again by SBI. The bank has increased the marginal cost of lending rates by 10 basis points. After which the loan given by the bank to the customers will become expensive. The new rates will be effective from May 15. Earlier, MCLR was increased by the bank in April also.

EMI will increase

If you are also running a home loan, personal loan or car loan from SBI, then this step of the bank will increase your EMI once again. The country’s largest bank has increased MCLR for the second time in a month. Both the times this increase has been combined to 0.2 percent.

Changes made after repo rate hike

This change has been done by SBI after the increase in the repo rate by the Reserve Bank of India (RBI). Earlier this month, the RBI had increased the repo rate by 0.40 percent to 4.40 percent. After increasing the interest rate by SBI, loans of other banks are also expected to become expensive in the coming days.

The new rates came into effect from May 15

After the increase in MCLR, the EMI of such customers who have taken loan on MCLR will increase. According to the information given on SBI’s website, the changed MCLR rate will be applicable from May 15. After this change, the one-year MCLR has increased from 7.10 percent to 7.20 percent. Earlier, FD rates were increased by SBI in the last days.