Big Update For Tax Payers: At present, annual investment of up to 1.5 lakh in many tax saving schemes such as home loan and life insurance policy is eligible for deduction under section 80C.

Section 80C Deduction Limit: If you also file ITR (ITR Return File) every year, then you will be well aware of Section 80C of Income Tax. Under this section, you get a rebate of up to Rs 1.5 lakh on investment. Taxpayers and tax experts have been demanding for the last several years to increase the limit of Section 80C. Not only this, in the Pre-Budget 2023 recommendation, ICAI had suggested the government to increase the deduction for Public Provident Fund (PPF) under section 80C from Rs 1.5 lakh to Rs 3 lakh.

July 31 was the last date to file ITR

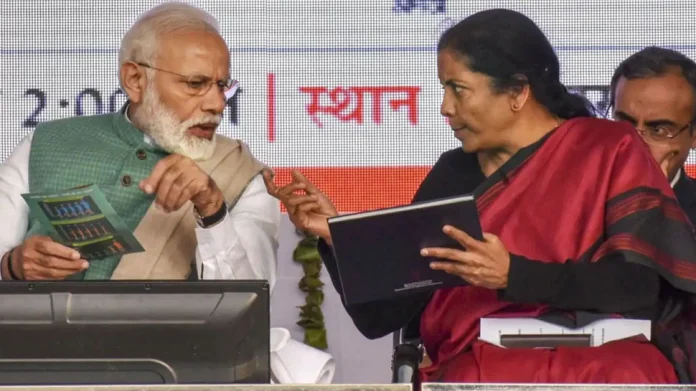

Now that the last date for filing ITR has been completed on July 31, the situation has been cleared by the government regarding increasing the limit of 80C. According to the Finance Ministry, there is no proposal under consideration to increase the exemption limit under Section 80C of the Income Tax Act, 1961. At present, annual investment up to Rs 1.5 lakh in various tax saving schemes such as home loan and life insurance policy is eligible for deduction under section 80C.

Proposal to increase exemption under 80C not under consideration

Tax saving schemes for deduction under section 80C include PPF, EPF, NSC, NPS, SCSS, 5 year FD in banks and post office, ELSS Mutual Fund etc. As such, there is no proposal under consideration to increase the exemption under section 80C of the Income Tax Act, Union Minister of State in the Ministry of Finance Pankaj Chowdhary said in a written reply to a question in the Lok Sabha on July 31.

The Minister of State for Finance was responding to a question ‘whether the government has recognized the need to streamline small savings schemes and simplify and enhance exemption under section 80C of the Income Tax Act in view of the changing economic environment and interest rate scenario. Have done. Let us tell you that in the year 2023-24, a record 6.77 crore ITRs have been filed.