Senior Citizens Tax-Saving FDs: Fixed Deposit (FD) is one such option where not only is the risk less, it also has the flexibility to choose different tenures.

Senior Citizens Tax-Saving FDs: Everyone wants to get maximum return on their investment. Talking about senior citizens, they often prefer to invest in such places, where they can save tax and at the same time get higher returns.

Tax-saving Fixed Deposit (FD) for Senior Citizens is one such option where not only is the risk less, it also has the flexibility to choose different tenures. Earlier its interest rates have been low, but recently many banks have increased their interest rates on FDs for senior citizens.

Why tax saving FD is a better option

Tax saving FD is a better option for senior citizens. It allows senior citizens to save tax on investments under Section 80C of the Income Tax Act, 1961. You can take advantage of maximum tax exemption of Rs 1.5 lakh in this.

But these deposits have a lock-in period of 5 years and premature withdrawal and loan against FD are not allowed. Tax saving FDs promise capital safety. Senior citizens prefer to invest their money in tax saving FDs to avoid sudden losses in a volatile market. FD helps senior citizens to generate regular income.

Senior citizens can earn 0.50% higher interest rate on tax saving FDs. Almost all banks offer higher interest to their senior citizen customers. Many tax saving FD schemes offer the option of a joint account but only the primary account holder can get tax exemption.

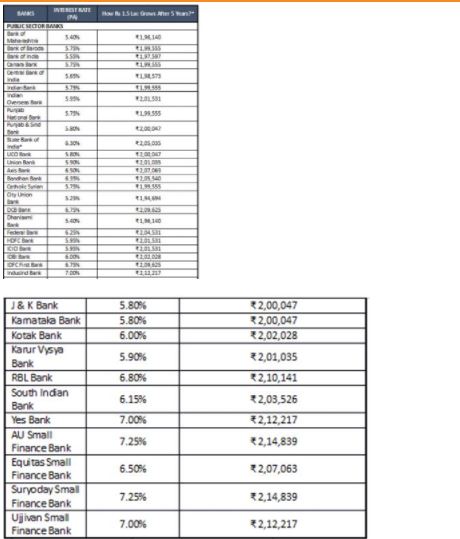

These banks are getting the highest returns

Senior citizens must keep some important things in mind before investing. First of all, you should compare the interest rates of different banks, so that you can invest where you are getting the highest returns.

If you are a senior citizen and planning to invest in tax saving FDs, then here we have listed the current interest rates of some of the leading banks. However, before investing anywhere, you should read all the terms and conditions related to it properly.

(Disclaimer- These figures have been taken from the respective banks’ websites as on March 15, 2022. Banks whose data is not readily available on their websites, have not been included. These data are available on online marketplaces for loans, credit cards etc. Compiled by BankBazaar.com.)