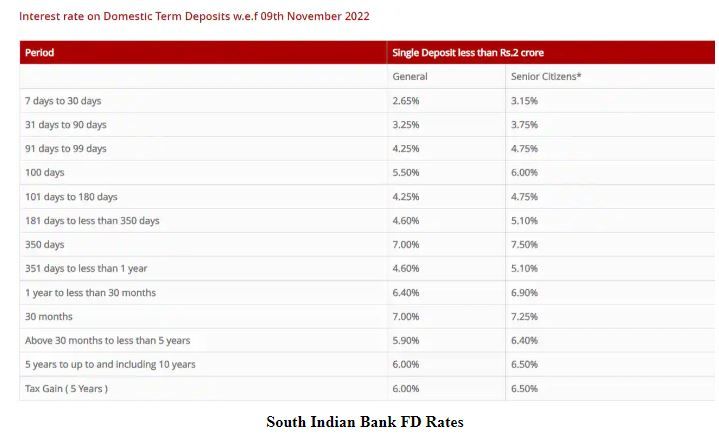

South Indian Bank FD Rates: Private sector lender South Indian Bank has revised the interest rates on fixed deposits of less than 2 crores. According to the official website of the bank, the new rates have become effective from November 9, 2022. After the revision, the bank now offers FDs with maturities ranging from 7 days to 10 years, with interest rates ranging from 2.65% to 6.00% for general.

3.15% to 6.50% interest is being offered for senior citizens. Highest interest rate on South Indian Bank deposits that mature in 350 days. At present it is 7.00 per cent for general public and 7.50 per cent for senior citizens.

South Indian Bank FD Rates

On FDs maturing in 7 days to 30 days, the bank is now offering an interest rate of 2.65% and on those maturing in 31 days to 90 days, South Indian Bank is now offering an interest rate of 3.25%. FDs maturing in 91 days to 99 days will now fetch an interest rate of 4.25% and FDs maturing in 100 days will now fetch an interest rate of 5.50%.

South Indian Bank is now offering an interest rate of 4.25% on FDs maturing in 101 days to 180 days and 4.60% on FDs maturing in 181 days to less than 350 days.

On FDs maturing in 350 days, the bank is now offering an interest rate of 7.00% and on those maturing in 351 days to less than 1 year, South Indian Bank is now offering an interest rate of 4.60%. Deposits maturing in less than one year to 30 months will now fetch 6.40% interest, while deposits maturing in 30 months will now fetch 7.00% interest.

The current interest rates offered by South Indian Bank are 5.90% for FDs above 30 months but less than 5 years and 6.00% for FDs maturing in 5 years to 10 years. The bank is now offering an interest rate of 6.00% for general public and 6.50% for senior citizens on tax benefit deposits made for a tenure of five years.

Senior citizen benefits are available only to residents, either individually or in a joint effort with another resident citizen or spouse. South Indian Bank mentioned on its website that “With effect from June 1, 2022, premature withdrawal and reinvestment of Retail Rupee Fixed Deposits (including NRE and Recurring Deposits) at the rate of 0.50% (for all tenors) Termination penalty is applicable. Deposit amount less than Rs. 5 lakh and 1% (for all periods) for deposits of Rs. 5 lakh and above.”

Besides this, interest rates on fixed deposits (FDs) have been increased by 75 basis points (bps) at Central Bank of India, by 60 bps at Indian Overseas Bank, by 15 bps at Kotak Mahindra Bank, and by 35 bps at HDFC Bank until.