According to the Income Tax Department rules, no one is allowed to hold more than one PAN number.

PAN or Permanent Account Number is a unique 10-digit number allotted by the Income Tax Department to an income tax payer. Having a PAN Card is mandatory for an income taxpayer but what if someone has two PAN Cards? According to the Income Tax Department rules, no one is allowed to hold more than one PAN number. Under Section 272B of the Income Tax Act, if someone has two PAN Cards, then the individual may end up paying a penalty up to Rs 10,000. Also, no two individuals or entities can hold the same PAN number as per the income tax rules.

Penalty for two PAN cards

As per the income tax rules, holding two PAN Cards is an offense. Anyone who has two PAN cards, will end up paying a penalty of Rs 10,000 under Section 272B of the Income Tax Act. Therefore, if a person has been allotted two PAN cards, then he should immediately surrender the additional PAN cards.

How to avoid penalty

If, in case, a person has acquired two PAN cards, then he must surrender the additional card immediately. Sometimes, on applying for a PAN online, it gets delayed and does not reach the tax-payer’s given address on time. In such conditions, the PAN Card applicant re-applies and ends up receiving two PAN cards with different numbers.

How to surrender PAN Card

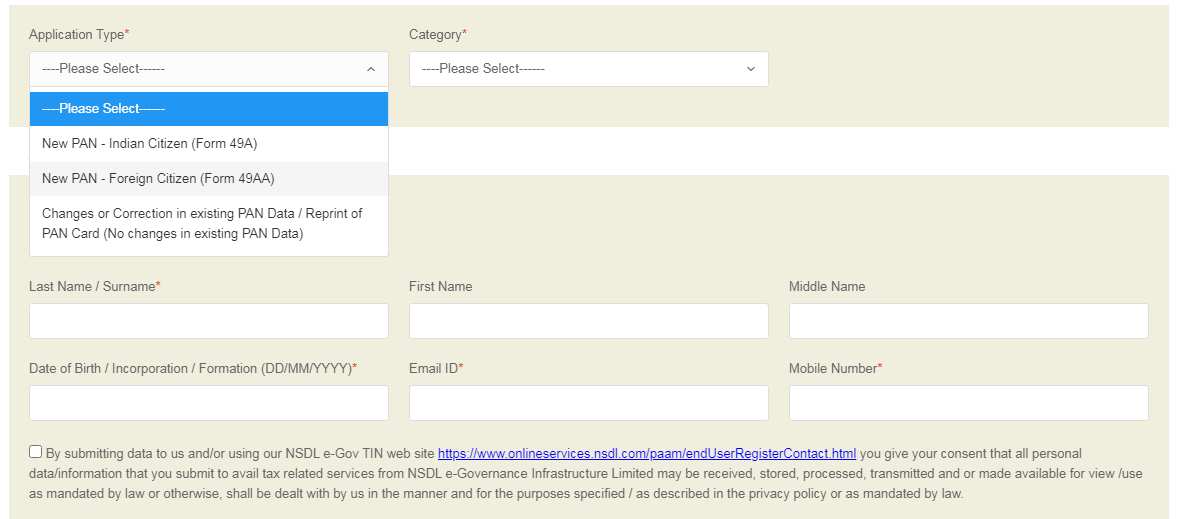

In order to surrender one’s additional PAN, one can either go online or submit the form offline. There is a common form for surrendering or for making any changes in the PAN

One can download the form from the link that says “Request For New PAN Card Or/ And Changes Or Correction in PAN Data” on the official NSDL website and submit it at any of the NSDL offices.

Source: www.zeebiz.com