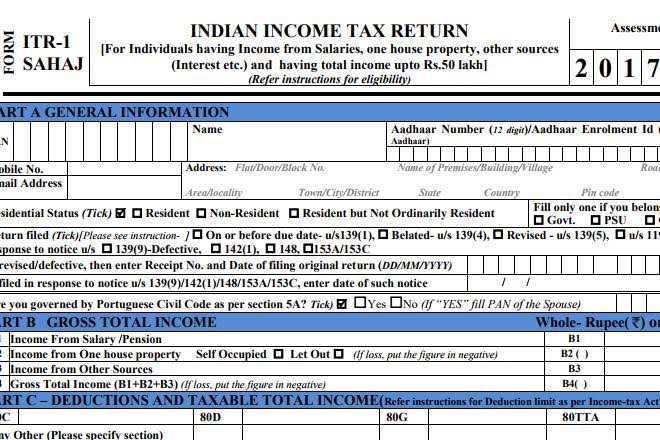

Income Tax Return Update date: If you also file income tax, then you should know that the filing of Income Tax Return for the financial year 2021-22 and assessment year 2022-23 has started from June 15, 2022, If you have not filed your return yet, do so immediately. Meanwhile, the government has also given a big statement on the extension of the last date.

Bumper discount on Flipkart, Redmi’s 10 thousand smartphone is being sold for only Rs 750, check full update here

Income Tax Return AY 2022-23: If you have not yet filed Income Tax Return, then fill it immediately. The last date for filing income tax return is July 31. The government has clearly refused to extend its last date, that is, now you have to file income tax before July 31 in any case. In fact, the Revenue Secretary has said that the government has no idea at present to extend the date for filing ITR beyond July 31. Let us tell you that the filing of Income Tax Return for the financial year 2021-22 and assessment year 2022-23 has started from June 15, 2022.

Indian Railways: The train suddenly changed some rules? Now the date of travel can be changed without canceling the ticket

Government told the deadline

Actually, like the last two years, this time too the last date for tax filing was expected to be extended, but now the government has made its stand clear. If you have received Form-16 from your office, then fill it without delay. If you do not fill it before the deadline, then you may have to pay a penalty. Apart from this, the load increases when more taxpayers file returns on Income Tax E-filing website. In such a situation, if you also want to avoid the problems in income tax filing, then do not wait for the last moment.

Bumper discount on Flipkart, Redmi’s 10 thousand smartphone is being sold for only Rs 750, check full update here

File your return before 31st July

It is noteworthy that the last date for filing income tax returns for the financial year 2021-22 and assessment year 2022-23 without any late fee is July 31, 2022. If you file income tax return after the deadline, then you will have to pay interest on tax along with penalty under section 234A and under section 234F of income tax.

Indian Railways: Railways started this great facility, night passengers became bat and bat, know full update

Detailed deadline for filing ITR

Apart from this, let us tell you that the last date for filing income tax return for personal HUF is July 31, 2022. At the same time, the last date for filing income tax returns for those who require audit is October 31, 2022. And for those who have business and in which TP report is required, the last date for filing income tax return is November 30, 2022. That is, the department has introduced a deadline for all types of income tax payers, if you do not pay tax before the deadline, then you will have to pay a penalty.