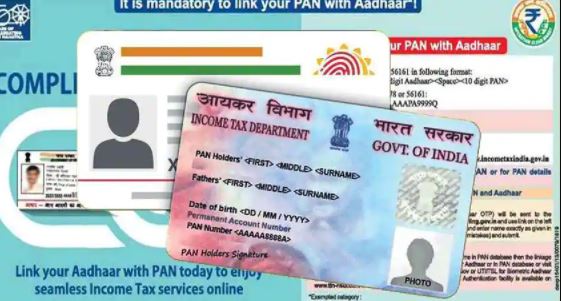

If you have not yet linked PAN card with Aadhar card, then do these things immediately because the last date is very near.

Actually, according to the Central Board of Direct Taxes (CBDT), you can link your PAN card with Aadhaar card till March 31. For those who are unaware, in 2017 CBDT announced that all Indian citizens will have to link their PAN card with Aadhaar card.

This move allows the Income Tax Department to detect any kind of tax evasion and also helps in reducing the issuance of multiple PAN cards, as many people make multiple PAN cards to cheat the government. take.

Significantly, the first deadline for linking PAN card and Aadhar card by CBDT was August 5, 2017, however, the department kept on extending the deadline due to various reasons. The new deadline released by the CBDT is March 31, 2022.

10 thousand fine.

However, you can still file income tax return without linking PAN card and Aadhar card, income tax department will not process your return till you complete the linking. Failure to link PAN and Aadhar card before the given deadline can lead to a fine of Rs 10,000 and further deactivation of the PAN card.

There are many ways in which you can link your PAN card with Aadhar card. To know how you can do that, you can follow these steps.

Link Aadhaar card and PAN card through SMS like this:

Step 1: Open the Messages app on your smartphone.

Step 2: Create a new message.

Step 3: In the text message section, type UIDPAN <12 digit Aadhaar number> <10 digit PAN number> and send SMS to 567678 or 56161.

You can also do the following by visiting the website:

Step 1: Visit the Income Tax Department’s e-filing portal – www.incometaxindiaefiling.gov.in

Step 2: Log in to the portal using your User ID, Password and Date of Birth. If you are not registered on the portal, you can easily do it using your PAN card.

Step 3: On the menu bar, click on ‘Profile Settings’ and select ‘Link Aadhaar’.

Step 4: Check whether the PAN card details displayed on the screen match with your Aadhaar card details.

Step 5: If there is any mismatch, then you have to get it rectified in any of the documents. If the details match, enter your Aadhaar number and click on the ‘Link Aadhaar’ button. You will be notified once your PAN card and Aadhar card are successfully linked.