According to the rules of IT, after payment of a certain amount, tax is applied on it, be it commission, salary or income from other sources. A part of the tax is deducted on it. The deducted amount gets deposited in the PAN card account.

Many times many people have doubts about TDS, in the present era there are many sources of income of the same person, in such a situation, his TDS keeps deducting in many incomes and he is not aware of it. At the same time, some people do not file returns, due to which they lose the amount of TDS even though they are not in the purview of income tax.

People doing freelancing find things related to income tax, TDS very difficult, due to excessive work and mentality of not taking tension, some people do not want to churn on this subject. But have brought useful information for such people. Just understand that you can find out whether your TDS has been deducted or not through your PAN card.

According to the rules of IT, tax is applied on it after payment of a certain amount, it is available on income from commission, salary or other sources. On this only a part of the tax is deducted separately. This deducted amount gets deposited in your PAN card account.

Deducted amount gets refunded

If you do not fall in the income tax slab, then you get this TDS money back, for this you have to file ITR. As soon as you enter the PAN number in the ITR, your entire record gets attached to it. If you are outside the tax slab, the TDS amount is refunded.

Check TDS Status By Pan Card

TDS which stands for Tax Deducted at Source (TDS) is a means of collecting income tax from individuals and entities under the Income Tax Act of 1961. All amounts covered under the provision of TDS is needed to be paid after deducting the prescribed percentage. TDS which is managed by the Central Board of Direct Taxes (CBDT) comes in handy while conducting tax audits.

What is TDS return?

TDS Return is a quarterly statement which is needed to be submitted to the Income Tax Department.

Details Contained In TDS Returns

TDS returns include details of the deductor(s) Permanent Account Number (PAN), particulars of the tax paid to the government, information regarding the TDS challan among other details as required in the forms that are to be submitted.

How To Check TDS Status By Pan Card?

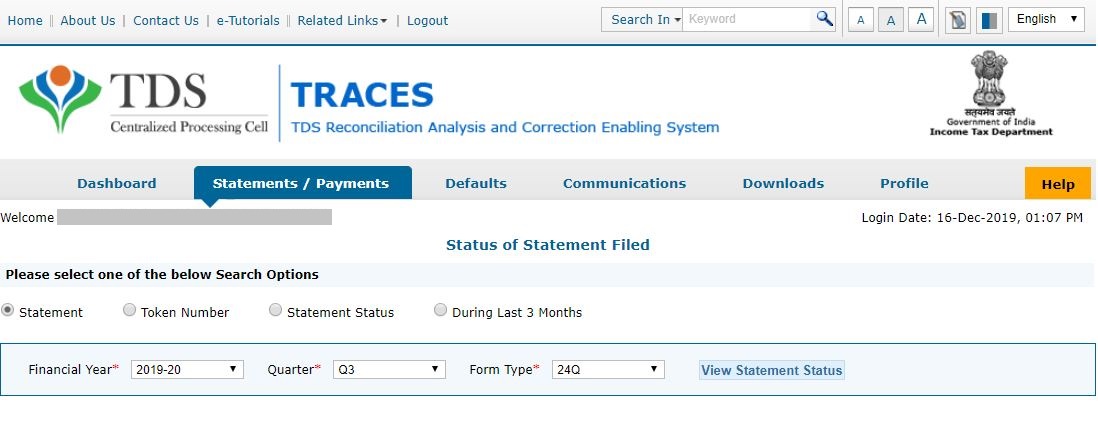

To check the status of TDS using the PAN card, one needs to follow the steps mentioned below:

- Visit www.tdscpc.gov.in/app/tapn/tdstcscredit.xhtml

- Key-in the verification code

- Click on ‘Proceed’

- Enter the PAN and TAN

- Select the financial year as well as the quarter and the type of return

- Click on ‘Go’

- The details will be displayed on the corresponding screen

How To Check TDS Credit Using Form 26as?

In a bid to check TDS credit using Form26AS, one needs to follow the steps mentioned below:

- Visit www.incometaxindiaefiling.gov.in/home

- Register yourself

- If already a registered user, log in using the credentials

- Go to ‘My Account’

- Click on ‘View Form 26AS’

- Select ‘Year’ and ‘PDF format’

- Download the file

- The file which is password protected can be opened by the Date of Birth as per the PAN card

- Apart from knowing TDS status through PAN and Form 26AS, one can also view their TDS online by using the net banking portal. However, for that, the PAN has to be linked to the net banking portal.